‘Debt’ is a common word among most of the Indians, especially in middle-class backgrounds. The word also means the same here, but the scenario is a bit different. Today, I am going to discuss about the less-popular debt funds because these fund has its own importance and must be in your portfolio.

Many a times, people compare it with other investment options like equity or real estate in the return point of view.

This is a wrong mindset.

It should be clear that the main purpose of debt funds is to offer fixed return and to provide stability in the investor’s portfolio.

Moreover, limiting our options to just the share market makes our portfolio a little risky too.

Therefore, it becomes necessary to know about debt funds as well. In this article, we will look for what’s debt fund, how to choose the best debt fund, advantages of debt funds, and more.

Let’s start without delay!

What is Debt Mutual Fund?

Debt Fund is a type of mutual fund which primarily invests in fixed-income generating securities such as Government Bonds, Corporate Bonds, Commercial Papers(CP), Certificate of Deposit (CD), Treasury Bills (or T-Bills), and many other money market instruments. These securities comprise of 65% of the total assets of mutual fund.

Debt funds are one of the safest investment options available to investors who are risk-averse and opt to make good return on their investments without jumping into the risk zone.

Advantages of Debt Funds

Here are some of the major advantages of debt mutual fund-

1) Fixed Income

Debt Funds invest in instruments which generate fixed interest/return. Like other mutual funds, debt funds also offer you two options- Growth and Dividend.

The former (Growth) allows you to reinvest the interest you earned on your investments. In contrary to this, you are able to withdraw this interest in dividend option. This serves as a perfect source of regular income for senior citizens and retirees.

2) Provides stability to the portfolio

This is one of the major benefits one avail from investing in debt funds.

As I have discussed, debt funds invest a major portion of the investor’s money in debt securities such as company or government bonds. This makes them more stable and less-volatile than the equity instruments where share prices may fluctuate over a wide range.

Having debt funds in your equity portfolio can provide stability to it by minimising risk associated with it.

3) Liquidity

Debt Funds provide high liquidity to the investors. They can put their money in debt funds and redeem whenever they feel the need.

The redemption money is credited to your bank account in T+2 days for debt funds. This is T+1 day for liquid funds. (Here T is the transaction date, i.e., when you redeem from debt mutual fund)

4) Can act as an Emergency Fund

Emergency funds act as a saviour during unforeseen situations. Every investor should put some part of their savings in Emergency fund to meet expenses of unpredicted situations like road accidents, etc.

Debt fund can be a great alternative available to you for this purpose. The reason is its high liquidity, low risk and ability to provide higher return than the Bank FDs and other similar investment options.

So, if you too are looking to create an emergency fund, debt fund can be the end of your search!

5) Superior Returns

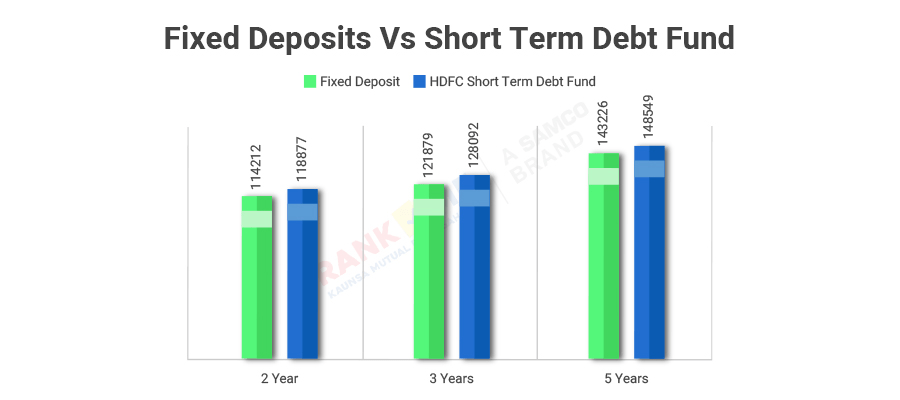

Debt Funds offer better returns than the traditional Bank FDs. The chart below shows the performance of Bank FDs Vs HDFC Short-term Debt Fund. (Consider initial investment of Rs 1 Lakhs and tax bracket of 30%)

How to Choose Best Debt Fund?

Here are some of the factors you must consider before investing in Debt Mutual Fund-

1) Risk Profile

This means that your risk-appetite should align with that of the debt scheme you are going for. If you are a conservative investor with the intention of risk-free investment, then you should not choose higher risk-profile debt scheme like Credit Risk Debt Fund.

Similarly, an aggressive investor should not invest in scheme like Liquid Funds as it comes in the category of low-risk profile and would be of no use if you are intended to earn higher return on your investments.

2) Investment Horizon

Investment Horizon is also known as the Time Horizon. It is the time period for which you are willing to invest in a particular fund.

As far as investment horizon is concerned, it should be noted that every debt scheme fits with its own investment horizon.

For example- If you consider scheme such as Credit Risk Debt Fund and Gilt Fund for short-term investing (<3 Years), you may not be benefited with rewarding return as they are long-term funds.

In the same way, Overnight Funds are quite useless for long-term investors.

As a wise and conscious investor, you should match your investment horizon with the fund’s average maturity.

For Example- The average maturity of Axis Corporate Debt Fund – Regular Plan is 2.12 years and average maturity of IDFC Government Securities Fund – Constant Maturity Plan – Regular Plan is 9.34 years.

So here, if you want to invest in long-term (say 10 years), then you should not choose Axis Corporate Debt Fund. As per your time horizon, IDFC Government Securities Fund – Constant Maturity Plan – Regular Plan would be a better deal for you.

3) Loads and Expenses

Debt Fund charges a fee from investors to manage their investment. This fee is known as the expense ratio.

As expense ratio is deducted from our NAV, it has a direct impact on the fund’s return. Therefore, you should not ignore expense ratio of a fund before investing into it.

In the same way, debt funds levy penalty if you redeem before a specified time period. This is known as Exit Load. To avoid this, you must check the fund’s exit load and action period (of exit load) prior to the investment.

Who Should Invest in Debt Fund?

Debt Funds can be a great deal if you are conservative and seek capital appreciation at low-risk. Moreover, Debt fund caters a wide range of options to the investors with different investment horizon. The only thing you need to do on your part is analyse your goal and choose a suitable time horizon for the same. This would help you pick a suitable debt fund aligning with your goal.

In this article, we have discussed about debt funds, its advantages, things to consider before picking a right fund, etc. Now let’s conclude it out!

Conclusion

As you are in the Conclusion section, I am pretty sure that you must have understood the importance of Debt Funds.

Debt funds can be a good starter if you are a novice and are afraid of loss in the financial market.

This doesn’t mean that you should not consider investing in share market. You can begin with debt funds and gradually raise your allocation to equities as your confidence grows.

However, there is a rule that the percentage of your debt fund investment must equal to your age.

If % of Debt Allocation= X, then % of Equity Allocation=100-X

(Here X is investor’s age)

This means that if an investor’s age is 25 years and he has Rs 100 to invest, then Rs 25 should go towards debt funds and Rs 75 towards equity funds (or Share Market).

Choosing a best debt fund as per your time horizon can give you the benefit of better liquidity, higher return and tax efficiency over traditional investment options like Bank FDs.

So, if you are a beginner planning to step-in the safer investment option that can guarantee you fix but decent return, debt fund can be the one option for you!

This was all about Debt Mutual Fund.

Hope you find it informative!

In the meantime, if you have any query or suggestions regarding this topic, fell free to connect me through the comment section below!

Till then, Happy Investing👌