Do you find it difficult to track your expenses? Does your budget surprise you?

If you have such questions in your mind, then you must read this article as we are going to discuss the 50-30-20 rule.

This rule helps you utilize your salary in the best possible way and saves you from unnecessary expenses.

Let us know about this principle in detail.

What is the 50-30-20 Rule?

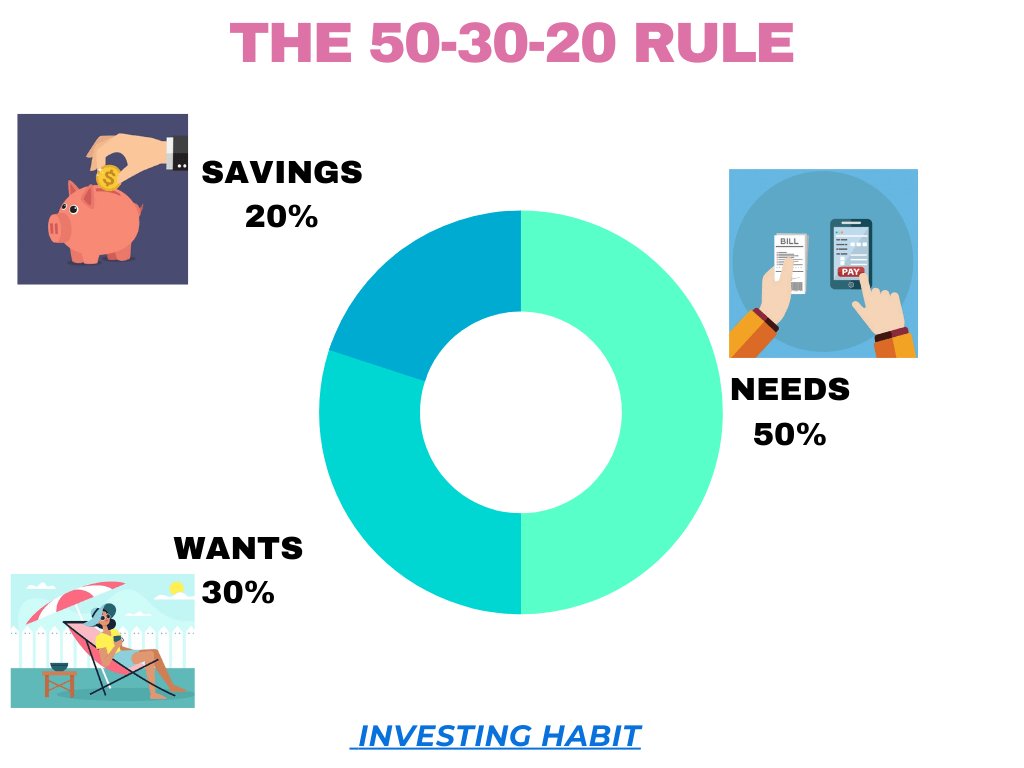

The rule of 50-30-20 is a method to divide and allocate your post-tax salary into three different components- Needs, Wants, and Financial Goals.

As per the rule, you should set up a budget of 50%, 30%, and 20% of your salary for these categories respectively.

Let us know more about these components.

Components of the 50-30-20 Rule

As I have discussed in the previous section, this rule consists of three components- Needs, Wants, and Financial Goals.

Needs

This component includes expenses incurred on your daily needs, such as-

- House Rent (or EMI)

- Food

- Clothes

- Bills like electricity, water, phone and internet bills, etc.

These are some of the expenses without which your life can’t run smoothly. You should allocate 50% of your net pay for your needs.

Wants

This category includes expenses that do not affect your life, but everyone wants to spend on such things. They might include:

- Eating in restaurants

- Expenditures on entertainment like watching movies in theatres, Netflix subscriptions, etc.

- Purchasing expensive phones, luxury cars, etc.

- Purchasing expensive clothes, footwear, etc.

- Vacations

As per the 50-30-20 Budget Rule, you can spend 30% of your post-tax income to fulfil this section.

Financial Goals

This is the last but most important component of the 50-30-20 rule. According to this rule, you should allocate 20% of your take-home pay to savings and investments.

You should build an emergency fund of at least 3–6 months to overcome unforeseen situations. Once you create this fund, you can shift your focus towards investment options like mutual funds, share markets, gold, bonds, etc. This way, you can contribute each month to attain financial freedom and meet retirement goals as well.

An Example of the 50-30-20 Rule

So far in this article, we have discussed the 50-30-20 rule and its components. Let’s look at an example to help you understand the concept.

Suppose Amit works in the IT department of XYZ Company and his post-tax income is Rs. 50,000. He adheres to the 50-30-20 rule to manage his expenses and achieve his retirement goals. As per the rule, he devotes 50 percent of the income, i.e., Rs 25000 for the expenses of his needs. He allocates 30% of his income, i.e., Rs. 15,000 towards the wants section, and invests the rest of the amount, i.e., Rs. 10,000 to shape his future.

Similarly, you may also set a limit for these fields according to your salary.

The 50-30-20 rule gives you a rough idea of how to divide your income into expenses and investments.

However, experts agree that as you progress in your career, you should split your income as follows: 40-20-40.

This is because your needs and investments are more important and should be given more priority. It also does not mean that you are paying less attention to your favourite, namely- The Wants Section. Let’s see how it goes.

Assume Amit’s after-tax pay rises to Rs 90,000 after a few years. As a result, he may now contribute 20% of Rs 90000, i.e., Rs 18,000 for the realization of his wants and luxuries.

How to Apply the 50-30-20 Rule?

1. Calculate your After-tax Salary

Before adopting this rule, you should understand your salary structure very well.

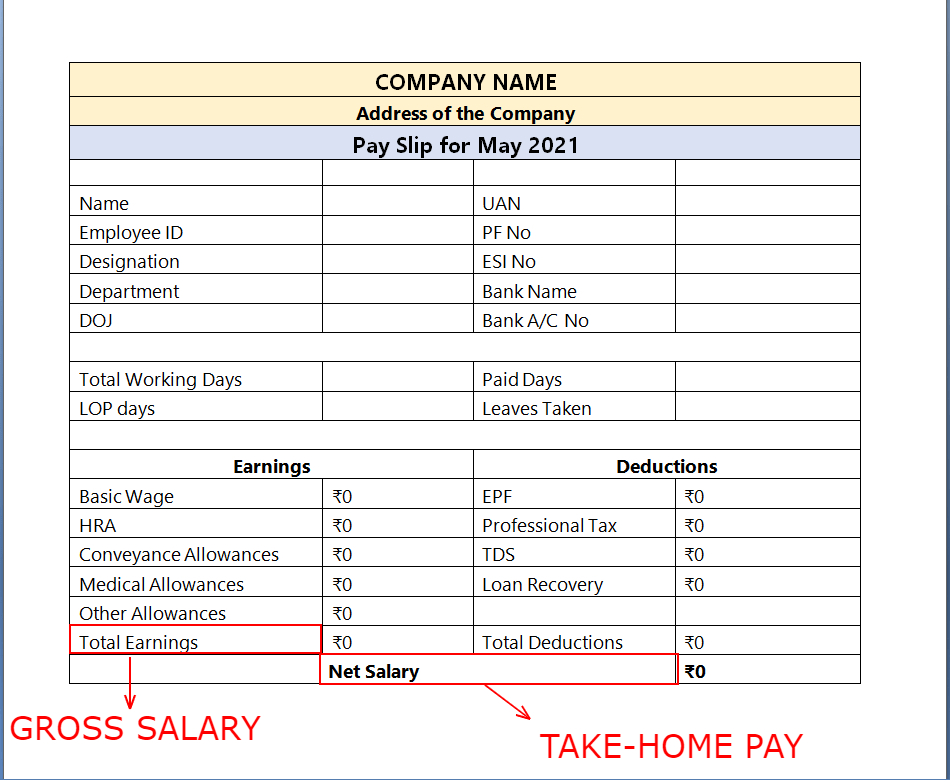

The salary structure of an employee includes allowances such as HRA, Transport Allowance (TA), PF, etc in addition to the basic pay.

Gross salary is the amount you receive before any deductions like income tax (if any), professional tax provident fund, etc. This salary includes basic salary along with other allowances and perks received by an employee. Read more about Gross Salary from here.

Gross Salary = Basic Pay + HRA + Other Allowances

Net salary is the salary that you get after all deductions like PF, professional tax, income tax, etc. This is your take-home pay.

Net Salary = Gross Salary – Income Tax – Professional Tax – Provident Fund (PF)

The 50-30-20 rule applies to your after-tax income. As a responsible employee, you must calculate and check this salary before further action. However, in most cases, your employer himself makes such deductions and transfers the rest of the salary to your bank account. If your employer has deducted costs such as health insurance premiums, provident fund deposits, or other retirement benefits, you should add them back in with your net pay.

Post-tax Pay = Net Pay + PF or other retirement benefits (if any)

You can also calculate it as-

Post-tax Pay = Gross Pay – Income Tax – Professional Tax

Set a cap for each Category

As you calculate your salary, you need to set an expenditure cap for all the three categories.

Let’s say your monthly income is Rs 30,000. Then, as per the rule, you should allocate Rs 15,000 (0.5*Rs 30,000) to your needs. In the same way, you can give Rs 9,000 to your wants, and the rest Rs 6,000 to savings and investments.

Plan Your Budget

In the end, you need to track your expenses and adjust according to your budget.

I hope this rule will help you take your first step towards financial freedom.

Thank You !!