If you invest in mutual funds or are investment conscious, then you must have heard about the term SIP.

Through SIP, we can invest small amount of our savings in a systematic and regular manner. It not only inculcates investment discipline in the investors but also encourages them to continue their investments for a longer period of time.

In this article, we will discuss various aspects related to SIP like meaning, how it works, benefits, etc.

What is Systematic Investment Plan (SIP)?

A systematic Investment Plan is a method of investing in mutual funds wherein you are allowed to invest a fixed amount at regular time intervals.

The decision regarding the time intervals is in your hands and you can choose to invest weekly, monthly, quarterly, semi-annually and yearly as per your convenience.

How Does SIP Work?

SIP works similar to a piggy bank where you deposit a small amount of your savings at regular time intervals. Here you need to specify a date and amount as you begin your investment.

However, if you want to opt out of the hassle of Manual SIP Payment, you may choose to automate your investment via Electronic Clearance Service (ECS).The set amount (as you decide) is auto-debited from your bank account at each SIP Date.

Based on the current Net Asset Value (NAV) of Mutual Fund, an additional number of units are allotted to the investors in return of the amount they pay on each SIP instalment. This means you buy more units when the NAV is low and able to buy less units when the NAV is high. This concept is known as Rupee Cost Averaging.

Benefits of Investing in SIP

SIP is an easy and convenient way to invest in mutual funds. You can avail higher returns in future by investing a small amount regularly through SIP.

It offers various benefits to the investors. Let us talk in detail one by one.

1. Convenience

You can start your SIP with a minimum amount of ₹500.

Such facility of SIP encourages even low-income investors to invest over a long period of time and earn high returns.

2. Rupee Cost Averaging

We know that market is volatile in nature and it is difficult to predict the market trends or wait for the right time to invest in the stock market.

So the question is, how can we get rid of this problem?

This is possible with Rupee Cost Averaging (RCA) which comes as an advantage with SIP.

Rupee Cost Averaging helps us to buy more units when the market is down and we are able to buy fewer units when the market is up. This lowers your average cost per unit and helps in maximizing profits in the long run.

Let us understand this concept with the help of an example.

Suppose Sharma ji started an SIP in XYZ Mutual Fund with a fixed amount of Rs 1000 for one year. The following table depicts his entire investment process through SIP:

| MONTH | SIP AMOUNT | NAV | NO. OF UNITS |

| Month 1 | ₹ 1000 | 10 | 100 |

| Month 2 | ₹ 1000 | 08 | 125 |

| Month 3 | ₹ 1000 | 05 | 200 |

| Month 4 | ₹ 1000 | 08 | 125 |

| Month 5 | ₹ 1000 | 10 | 100 |

| Month 6 | ₹ 1000 | 20 | 50 |

| Month 7 | ₹ 1000 | 25 | 40 |

| Month 8 | ₹ 1000 | 20 | 50 |

| Month 9 | ₹ 1000 | 10 | 100 |

| Month 10 | ₹ 1000 | 08 | 125 |

| Month 11 | ₹ 1000 | 04 | 250 |

| Month 12 | ₹ 1000 | 10 | 100 |

Let us find out his profit in one year.

Total Investment = Rs 12000

Total units earned = 1365

- Average Cost per unit = Total Investment/Total units earned = 12000/1365 = 8.79

- Average Price (value) per unit = Sum of all NAVs/Time span (months) = 138/12 = 11.5

It is obvious that the average cost per unit is less than the average price per unit. This means Sharma ji made an average profit of Rs 2.71 on every units purchased by him.

This is how you benefit from Rupee Cost Averaging by investing through SIP.

3. Power of Compounding

The Great Scientist Albert Einstein once said-

Compound Interest is the 8th wonder of the world. He who understands it, earns it…he who doesn’t…pays it

What exactly a compounding is?

Compounding is a great way to generate income on the re-invested income. It works on two basic premises:

1. Re-investment of income

2. With the passage of time

If you really want to take advantage of the Power of Compounding then start your SIP soon and try to continue investment over the long tenure. The sooner and longer you invest, the more benefit you will get from compounding and the higher will be your returns.

Let us understand with the help of an example.

Suppose three investors A, B, and C started an SIP in the same mutual fund with same amount of Rs 5000/month. Let A, B, and C continue their investment for 10, 20 and 30 years respectively.

The following table depicts their entire investment process:

| INVESTOR | TIME PERIOD (YEARS) | EXPECTED RETURN | DEPOSIT AMOUNT | MATURITY AMOUNT | TOTAL INTEREST |

| A | 10 | 12% | ₹ 6,00,000 | ₹ 11,61,695 | ₹ 5,61,695 |

| B | 20 | 12% | ₹ 12,00,000 | ₹ 49,95,740 | ₹ 37,95,740 |

| C | 30 | 12% | ₹ 18,00,000 | ₹ 1,76,49,569 | ₹ 1,58,49,569 |

I hope the above table makes you clear about the power of compounding!

4.Excellent Returns

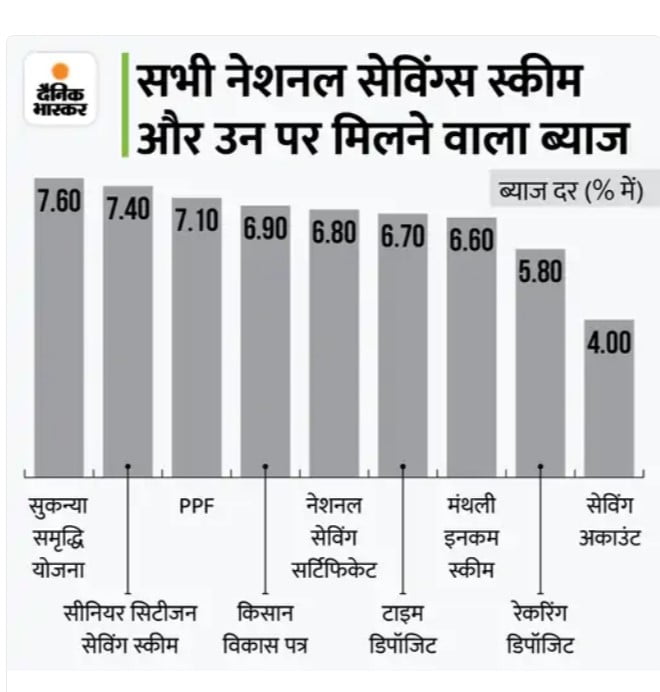

SIP has given higher returns than many Government Schemes and other traditional investment options like Bank FDs.

Many such investment options fail to deliver returns even up to the inflation rate.

SIP has the potential to give you returns much higher than the average inflation rate in the long period of time. Generally, SIPs can give you returns in the range of 10-20% over an investment horizon of more than ten years.

5.Brings Financial Discipline

SIP inculcates the habit of investment discipline among investors as they commit to invest at regular intervals of time through it.

Many investors forget to pay their instalment on time. Do you find yourself in the same category?

If yes, you may choose to automate your investment process. This can be done via ECS or by issuing equivalent number of post-dated cheques as your SIP instalment.

This would let you invest a set amount on each SIP date (as decided by you) even you’re busy with your work. You’ll never notice the difference, but your money will grow over time.

6.Flexibility

SIP gives you the following flexibility as an investor :

- You can Skip, Stop and Start an SIP-

You will not have to pay any fine in case you miss an SIP payment or want to stop the SIP for any reason. This gives you an edge over investment options like Recurring Deposits, where you have to pay a fee in such a situation.

Apart from this, you can start a new SIP in any mutual fund (same or different) of your choice as soon as you start saving more!

- You can increase or decrease the SIP Amount-

SIP gives you the flexibility to increase or decrease the amount as per your requirement.

As soon you get promoted or able to save more, you can increase your SIP amount with Top-up facility. Also, in case of any decline in your Professional Life, you can choose to decrease the amount.

Such a facility encourages investor to continue his/her SIP investment in any situation. Isn’t it amazing?

Is there a Right Time to Invest in SIP?

This is a common question among investors. They often get confused in choosing the right date for SIP.

But…

Let me make it clear that if you invest via SIP, then you do not need to worry about the right time to invest. This is because you get the benefit of Rupee Cost Averaging, which helps you to beat the market swings.

Set a suitable date and keep your investment regular. This is the only thing you need to execute on your part.

This was all about SIP. Hope You Enjoyed Reading the Article!

HAPPY INVESTING😊