A few days back, HDFC and PhonePe came together to announce the launch of the “PhonePe HDFC Co-branded Credit Card”.

This was a historic moment for PhonePe. We mostly know PhonePe for its huge presence in UPI payments. But now for the 1st time, PhonePe is stepping into “Credit Card” segment as well.

PhonePe HDFC co-branded credit card are available in two variants- the “Ultimo” for premium benefits and the “UNO” for everyday uses. They both operate on the Rupay network.

In this blogpost, we will discuss about PhonePe HDFC Ultimo Credit Card Review.

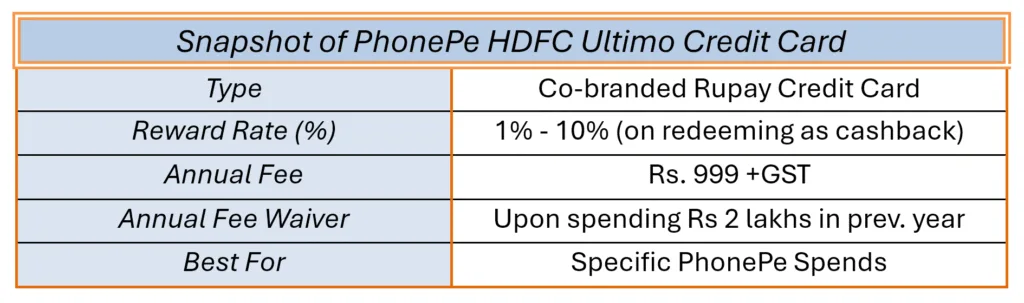

PhonePe HDFC Ultimo Credit Card: Overview

PhonePe HDFC Ultimo, as I’ve said before, is a premium variant. We can earn up to 10% cashback on specific UPI spends on the PhonePe app.

Both the joining fee and the annual fee for the PhonePe HDFC Bank Ultima Credit Card are ₹999 plus applicable taxes. However, you can avoid the joining fee of Rs 999 if you’re somehow able to take the welcome benefit.

The annual fee for a year can be waived if you’ve spent Rs 2 lakhs or more in the previous year.

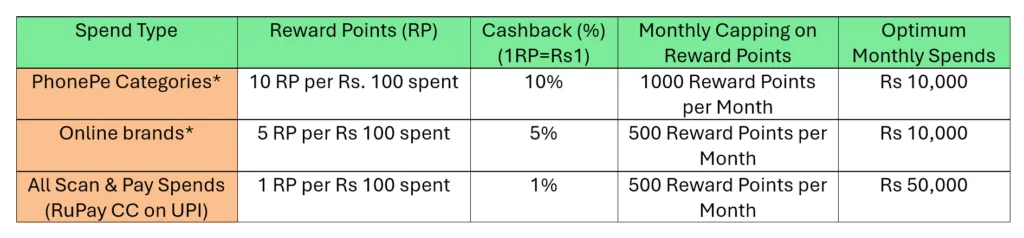

Reward Points

PhonePe Specific Categories* : Recharges, Bill Payments, Travel Bookings (Flights, Buses, Trains, and Hotels), and Spends on Pincode (a hyperlocal delivery app by PhonePe)

Online Brands* : Amazon, Flipkart, Myntra, Ajio, Uber, Swiggy, and Zomato

There are some points you need to keep in your mind —

1. For earning reward points, you need to ensure that all the spends are done via “Rupay CC on UPI”.

WTF is this?

If you are a regular card swiper, you might have heard of linking credit card to UPI Apps. This feature enables easy and safe digital payments, and allow us to pay via credit card instantly on the UPI apps.

Here are the steps to link the RuPay credit card for UPI Payments on PhonePe:

Step 1: Open your PhonePe app

Step 2: Tap “RuPay on UPI” under the “Manage Payments” section

Step 3: Choose the bank issuing your RuPay credit card (e.g. HDFC Bank Credit Card in this case)

Step 4: Tap “Set UPI PIN”.

Step 4: Enter the “Last 6 digits of your card number” and “Valid Up To” details

Step 5: Tap “Proceed”. Enter the 6-digit bank OTP sent to your registered number

Step 6: Enter the new UPI PIN which will be 4 or 6 digits

Step 7: Re-enter the UPI PIN for confirmation

2. List of spends that do not earn any reward points:

| List of Spends that are not Eligible for Reward Points | |

| Wallet Load | Rental payment |

| Fuel | Education Fees |

| EMI spends | Insurance |

| Gift Cards | Investments |

| Cash Advances | Govt. payment |

| Credit Card bill payment, fees, or any charges | Jewellery purchase |

Rewards Redemption

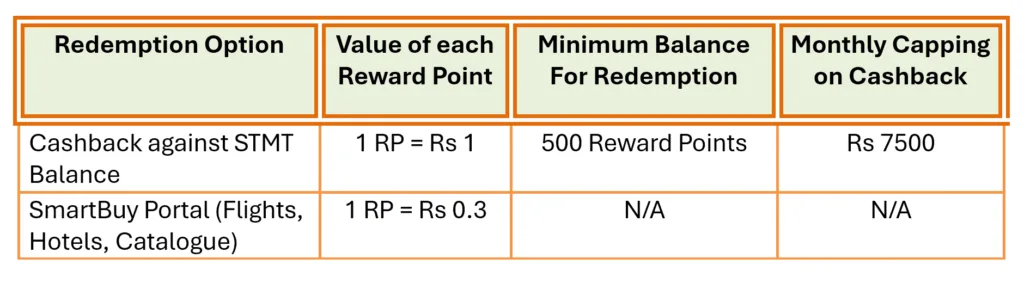

With the PhonePe HDFC Bank Ultimo Credit Card, we get two option to redeem our reward points:

- Redeeming as cashback against Statement Balance, and

- Redeeming on the HDFC SmartBuy Portal

Here’s a comparison of the redemption options available:

The best way to redeem your points, in my opinion, is to turn them into cashback and use them to compensate statement balance. This reduces your credit card bill.

Here, 1 Reward Point is worth Rs 1. This is a really good value for a co-branded card.

There’s a limit of Rs 7,500 cashback you can get each month. A big plus is that there’s no fee when you redeem for cashback against your statement balance.

However, getting cashback is not as simple as it seems. You’ve to “request” it. Also, you need a minimum balance of 500 reward points for redemption.

The second option is to redeem your cashpoints on the HDFC SmartBuy Portal for booking flights and hotels, airmiles, and reward catalogue.

But, in this case, the value of each reward point is Rs 0.30.

There is a significant drop in reward point value if we compare it with the cashback option. Even in the top-tier cashback category (10% reward points), you’ll be able to earn only 3% cashback.

So, in my opinion, it’s not a great deal to redeem points on the SmartBuy Portal.

Note*: All unredeemed reward points will be invalid after 1 year of accumulation. So, redeem them on time.

Welcome Benefits

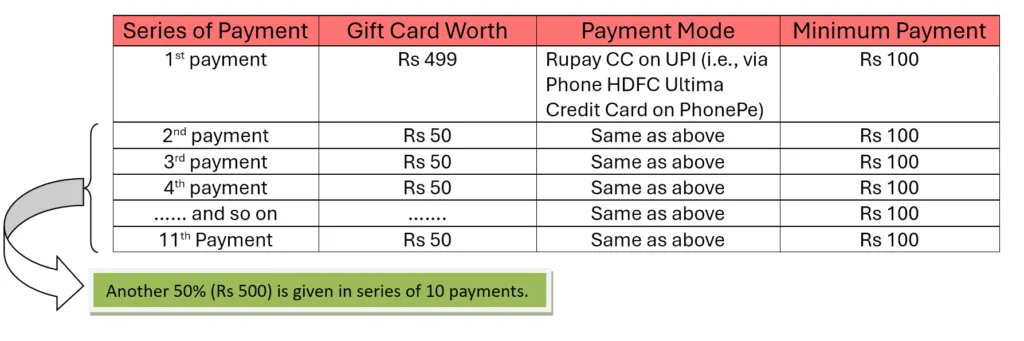

I found that the welcome benefit of PhonePe HDFC Ultimo Credit Card is designed to cover the joining fees.

And they have a unique way to provide this benefit. You get 50% of the joining fee, that is Rs 499, as PhonePe Gift Card on your 1st payment via Rupay Credit Card on UPI.

Another 50%, that is Rs 500, is then given in a series of 10 PhonePe Gift Cards, each worth Rs 50.

As you can see in the table, total Rs 999 {Rs 499 + Rs (50 x 10)} is provided to the user as welcome benefit, which they can use to eliminate their joining fees.

What I do not like?

I truly appreciate the intention of this card to cover joining fees.

But unlike other credit cards that give you one big bonus upfront, you have to make multiple small transactions over time to get the full benefit. This steady approach can feel a bit slow or even annoying for some users.

Complimentary Lounge Benefits

| Lounge Type | No. of Visits | Spending Condition |

| Domestic Lounge | 8 visits per Year {2 visits in every 3 months} | If You’ve Spent at least Rs 75000 in previous 3 months. |

Following categories do not count in the spending calculation:

- Cash Advances

- Credit card fees or any charges

- EMI spends

Fuel Surcharge Waiver

You get 1% fuel surcharge waiver on fuel spends between Rs 400 and Rs 5000.

This waiver is capped at a maximum of Rs 250 per month. You can save a little money every month if you buy fuel often.

Who Should Apply?

PhonePe HDFC Ultimo Credit Card isn’t for everyone. But it’s great for a specific kind of spender.

Here is the checklist:

- If PhonePe is your main app for recharges, utility bill payments, and travel bookings

- If you often buy things on any of these popular online brands: Amazon, Flipkart, Myntra, Ajio, Uber, Swiggy, or Zomato

Therefore, if your spending behaviour resonate with any of these use-cases, HDFC PhonePe Ultima can be a better choice.

In either case, you earn minimum 5% cashback.

How to Apply for PhonePe HDFC Ultimo Credit Card?

The PhonePe HDFC Ultimo Credit Card can only be applied via the PhonePe app. There is no any other option available, such as offline or website-based application process. You can’t even apply from the HDFC bank.

PhonePe HDFC Ultimo Credit Card Review: My Final Words 📢

PhonePe HDFC Ultimo Credit Card is a solid option, especially if you’re a digitally-savvy Indian consumer. You get generous reward of 10% and 5% on everyday things like recharges, utility bill payments, and online shopping.

The 1:1 reward point to cashback ratio is a big plus. Also, the ₹2 lakh annual spend for the fee waiver makes the card affordable for many users in the long run.

However, there are certain things which seems to be disappointing.

I personally do not like the spend-based condition for complimentary lounge benefits. It’s pretty challenging to maintain the monthly online spends of Rs 25000. Only high spenders can get their chance here.

This was all about the PhonePe HDFC Ultimo Credit Card Review. I tried my best to cover each and everything related to this credit card. But, if anyhow, I’ve missed some point, you can comment down below.

I will soon be posting a detailed comparison of PhonePe HDFC Ultimo Credit Card vs other RuPay credit card.

Till then, stay tuned!

Happy Saving!