SWYP Credit Card is an innovative offering by the IDFC FIRST Bank.

It is basically an EMI Credit card. You get the option to pay your balance in full or divide them into a set of monthly installments.

But the good thing is: no interest or processing charges are levied apart from the monthly EMI Fee.

Sounds interesting, right?

Let’s discuss more in this detailed “IDFC First SWYP Credit Card Review.”

OVERVIEW

| FEATURE | DETAILS |

| Type | EMI Credit Card |

| Best For | Travel |

| Reward rate | Up to 8.75% (hotel bookings) |

| Finance Charges (Interest) | 0% |

| Joining Fee | Rs 499 + GST |

| Annual Fee | Rs 499 + GST |

| Annual Fee Waiver | N/A |

| Renewal Benefit | 2000 Reward Points |

IDFC First SWYP Credit Card is a low-fee entry-level card suitable to the youngsters.

It eliminates the traditional concept of revolving credit at high interest rates.

But how?

Most of the traditional credit cards allow you to pay a Minimum Amount Due and carry the remaining balance to the following month.

This carried-over amount (also known as the revolving credit) incurs high interest charges.

But the SWYP credit card has no concept of revolving credit.

You get only two options to pay your outstanding balance:

- Pay the Total Payable Amount in full by the due date, or

- Split Eligible Balance into EMIs and pay them in the upcoming months.

So, in the end, you do not bother about the interest rates, and keep settling your bills within time.

REWARD POINTS AND REDEMPTION

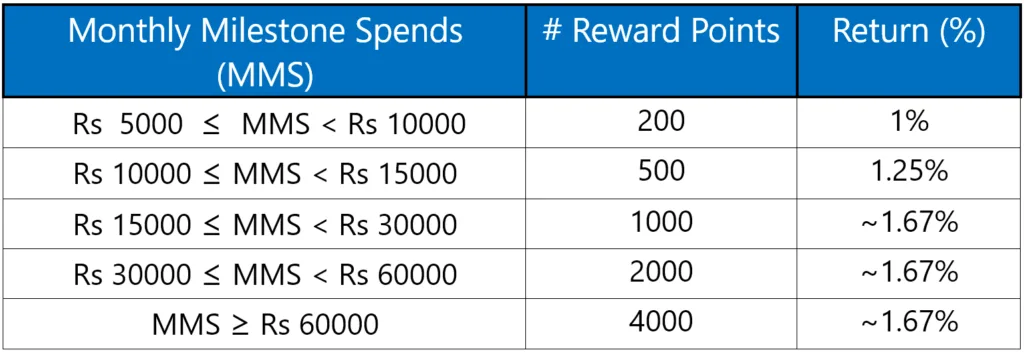

IDFC FIRST SWYP Credit Card offers a monthly milestone-based reward point system.

At each milestone spend, you get a definite no. of reward points.

But you must note that these points are not incremental, and is allotted based on the milestone level.

You get same no. of points on spending Rs 15000 or Rs 21000 in a month since they both belongs to the same milestone level.

All the above calculated return (%) are optimal.

You can calculate the optimal return (%) of any milestone level by dividing the minimum amount needed to earn all RPs of that level.

** Important Things to Note **

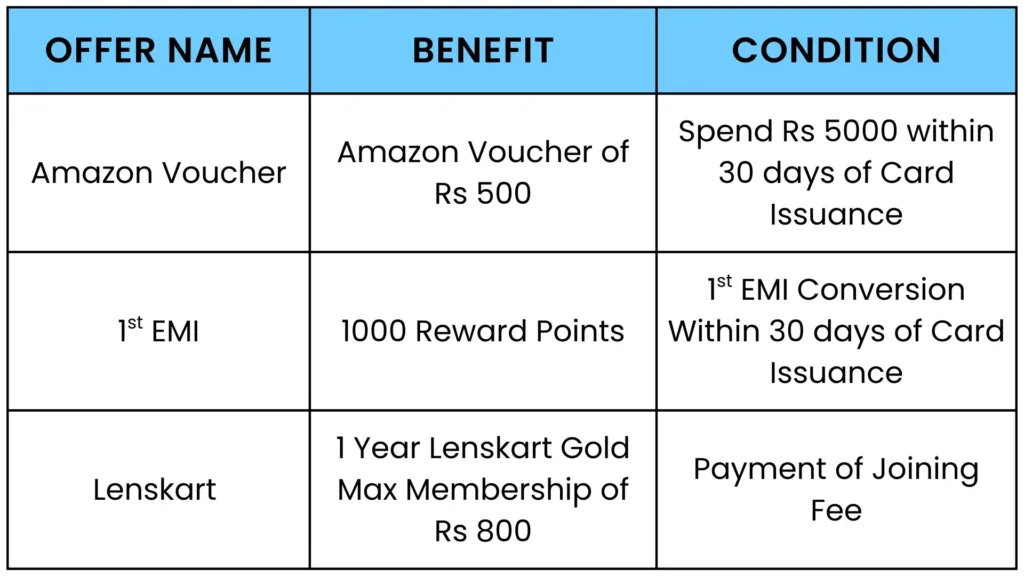

- 1 RP = Rs 0.25

- Redemption Fee of Rs 99+GST is levied per transaction

- Reward points never expire

BONUS REWARD POINTS ON TRAVEL

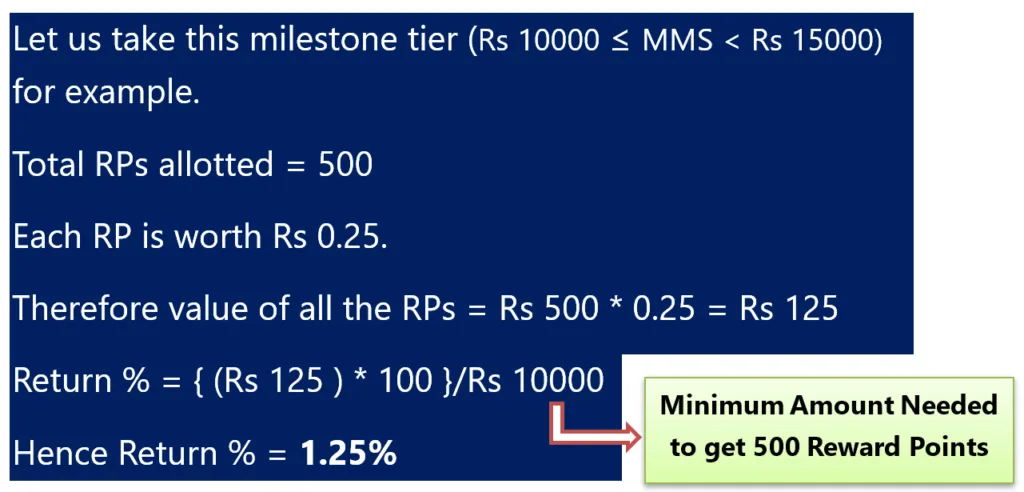

We get bonus RPs on flight and hotel bookings in addition to the monthly reward program.

Bookings made via the “Travel and Shop” section of the IDFC FIRST Bank Mobile App are only eligible for the Bonus RPs.

You can earn up to 8.75% return on travel bookings (8.25 times more than that of the ongoing spend).

** Note **

- You cannot earn more than 8000 bonus reward points on flight and hotel bookings in a calendar month.

- Suppose you’ve spent Rs 30000 on hotel bookings, then:

- Bonus RPs = (30000*35)/100 = 10500 > 8000

- ∴ Final Bonus Points = 8000

Redemption of Bonus Reward Points

- Bonus Points can be redeemed for flight and hotel bookings at the “Travel and Shop” section of the Mobile Banking App.

- 1 RP = Rs 0.25 for redemption

- Redemption Limit: you can redeem up to 1 lakh bonus points in a month and up to 2 lakh bonus points in a year.

- Redemption fee is Rs 99 + GST

- You can use your bonus points to pay upto 70% of the booking amount.

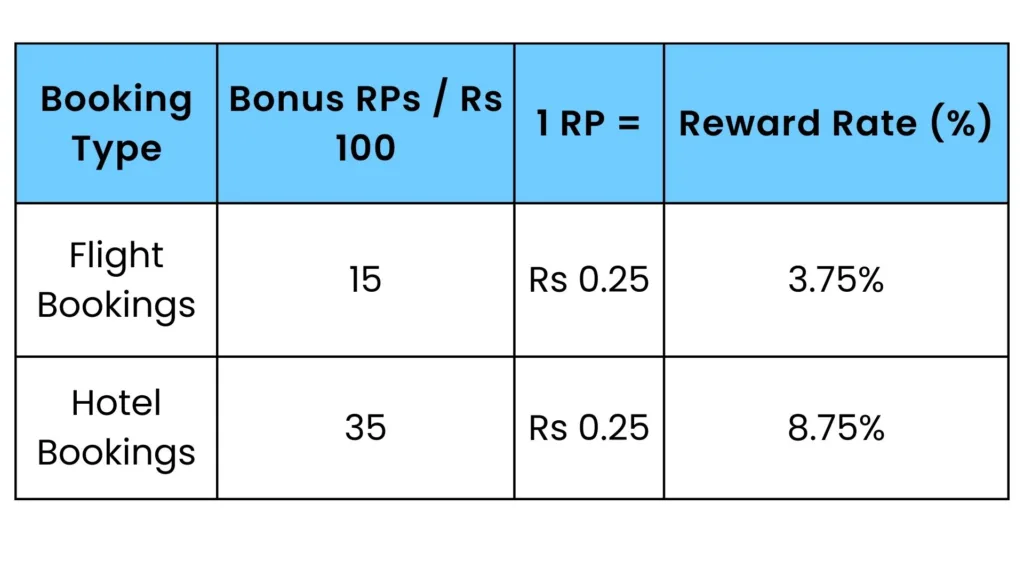

WELCOME OFFERS

You get amazing welcome offers on IDFC FIRST Bank SWYP Credit Card. Some of them are Amazon Voucher and Lenskart Membership.

You also get travel discount coupons on MakeMyTrip and EaseMytrip.

** Note **

- The MakeMyTrip Discount Coupon is valid only for 1 booking per card per category within 90 days of card setup.

- Hence, only 1 booking can be made either on flight or hotel (you decide).

- The EaseMyTrip Discount Coupon is valid once per month on either flight or hotel bookings.

- But you can use it only for the 1st three months post card issuance.

PARTNER BENEFITS

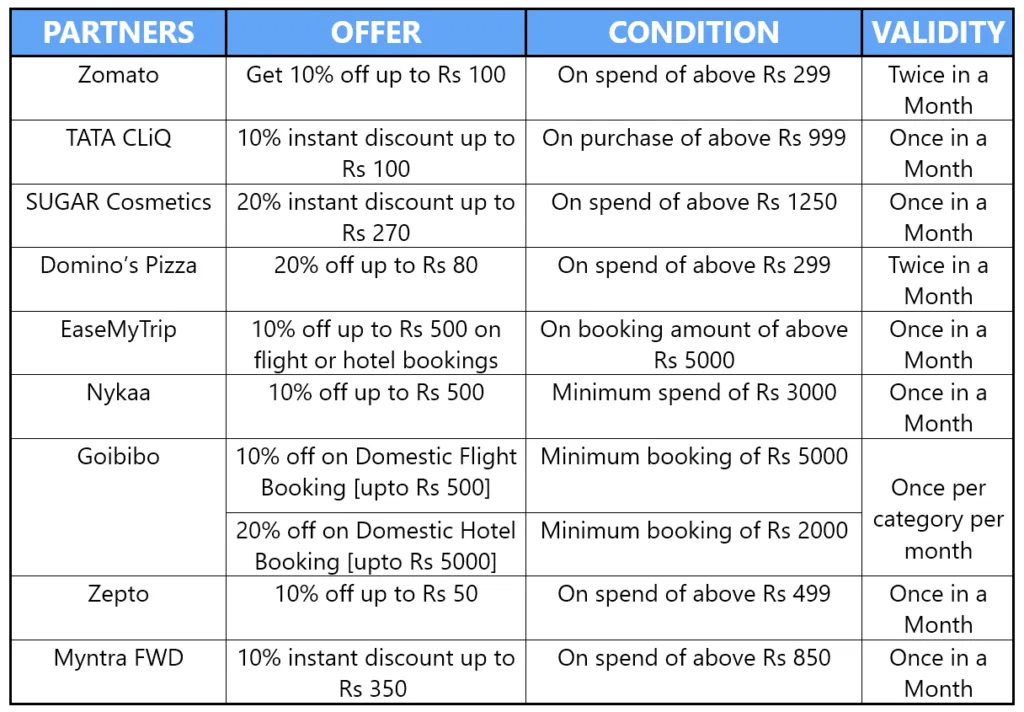

You can enjoy year-round discounts on a variety of partner brands. These brands serve in different categories like travel booking, fashion, beauty and makeup, and food delivery.

Here’s is the list of all partner benefits:

Other than food delivery (Zomato and Dominos), all other discounts are limited to once per month.

But since there are ton of brands, you can still maximize your savings each month.

MOVIE DISCOUNT

- Get 25% instant discount (up to Rs 100) on booking movie ticket.

- Applicable on movie ticket booking from the District App by Zomato.

- Use coupon code- IDFCCCFM during the checkout to get discount.

RAILWAY LOUNGE

You get 4 complimentary Railway Lounge Visits in every 3 months (16 visits/year).

Below facilities will be provided during the lounge visit:

- Two hours of lounge stay

- A/C sitting

- 1 Buffet Meal- can be breakfast, lunch, or dinner as per the time of visit.

- Unlimited tea and coffee

- Free Wi-Fi

- Newspaper and Magazine

AUTOMATIVE BENEFIT

FUEL SURCHARGE WAIVER

- 1% fuel surcharge waiver up to Rs 200 at all fuel pumps in India.

- Provided on fuel spend between Rs 200 to Rs 5000.

ROADSIDE ASSISTANCE

- Complimentary roadside assistance worth ₹1,399 is provided across India.

- You can utilize this service up to 4 times in a year.

FINAL THOUGHTS

The IDFC FIRST Bank SWYP Credit Card is a great option for “Gen Z” seeking to avoid the typical debt traps.

It’s available at low joining and annual fee. With ton of offers available, you can recover these costs easily.

The only downside is the lack of airport lounge benefits.

But other than that, IDFC SWYP Credit card shines on travel-related spends.

So, you can definitely think of IDFC FIRST BANK SWYP CREDIT CARD if you’re really looking for an innovative option.

This was all about the “IDFC FIRST SWYP Credit Card Review.

I hope you’ve loved the post.

Till then,

Happy Saving!!