ICICI Sapphiro Credit Card Review: Sapphiro Credit Card is one of the premium cards of the ICICI Bank. It is the second most popular after ICICI Emerald Credit Card.

This card promises a blend of rewards, travel perks, and lifestyle benefits that are designed to make your life a little more enjoyable.

From movie lovers to travelers— This card has some special benefits for everyone. But is it really worth it?

This ICICI Sapphiro Credit Card Review is going to cover all the aspects of this card including fees, welcome bonus, and more.

Let’s dive in and see what the ICICI Bank Sapphiro Credit Card has to offer!

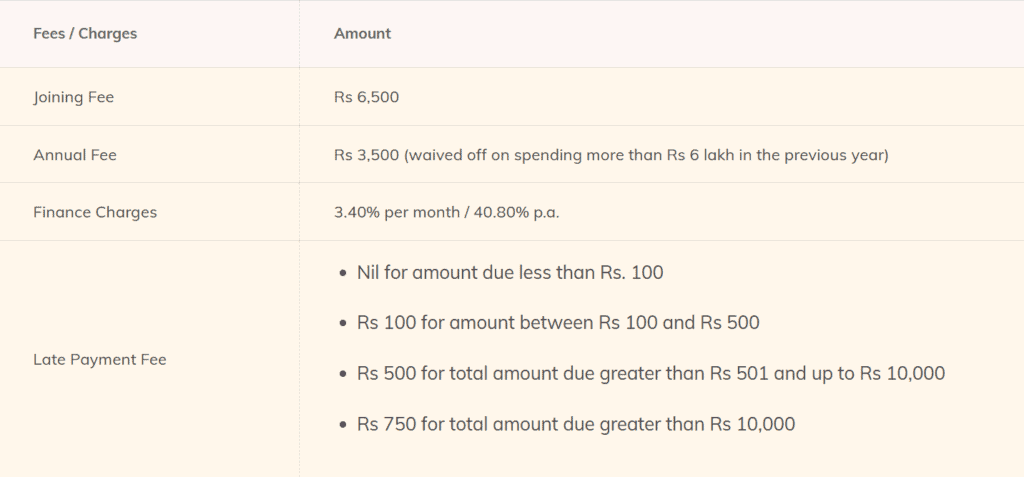

ICICI Sapphiro Credit Card Review: Fees & Charges

Let us begin the ICICI Sapphiro Credit Card Review with the Fees and Charges associated with the card.

This credit card charges a one-time joining fee of Rs 6,500 + GST.

You have to pay an annual fee of Rs 3500 + GST from 2nd year onwards.

No annual fee is charged for the 1st year (the year of receiving your card).

This Credit Card also offers a spending-based fee waiver. You do not have to pay the annual fee if you have spent minimum Rs 6 Lakhs in the last year.

You can see the late payment fee and other charges from the table below.

Image Credit: ICICI Sapphiro Credit Card Fees

ICICI Sapphiro Credit Card Reward Points

Unlike other cashback cards like Amazon pay ICICI Credit Card or SBI Cashback Credit Card, I found this card to be less-rewarding for shopping.

However, rewards have never been the main highlight of this credit card.

It is known for its welcome benefits and other premium features like lounge and golf round access.

Below is the breakdown of the reward points you can earn using this card:

- Domestic Spends: You get 2 reward points for spends of Rs 100 on domestic retail purchases (0.5% cashback).

- International Spends: 4 reward points for every Rs 100 spent on international purchases (1% cashback).

- Utilities and Insurance: 1 Reward points for every Rs 100 spent on paying utility bills and insurance premiums (0.25% cashback).

- Fuel Spends: No cashback

ICICI Sapphiro Credit Card Review: Welcome Bonus

ICICI Bank Sapphiro Credit Card provides various welcome benefits to the new users.

These vouchers can be availed for a range of purposes— From shopping to booking flights and cabs.

| Welcome Vouchers | Worth of Vouchers |

| Tata CliQ Vouchers | Rs 3000 |

| EaseMyTrip Vouchers | Rs 4000 (You get 4 vouchers worth Rs 1000 each). Each voucher can be used only once. |

| Uber Vouchers | Rs 1000 (You get 4 vouchers worth Rs 250 each). Each voucher can be used only once. |

| Croma Vouchers | Rs 1500 |

You should know about the EaseMyTrip Vouchers. The scheme is a bit different than others.

You get 4 vouchers each of worth Rs 1000 and each voucher can be used only one time. What does this mean?

Imagine you are planning a trip to Kerela with your friends.

You all are residing in Lucknow.

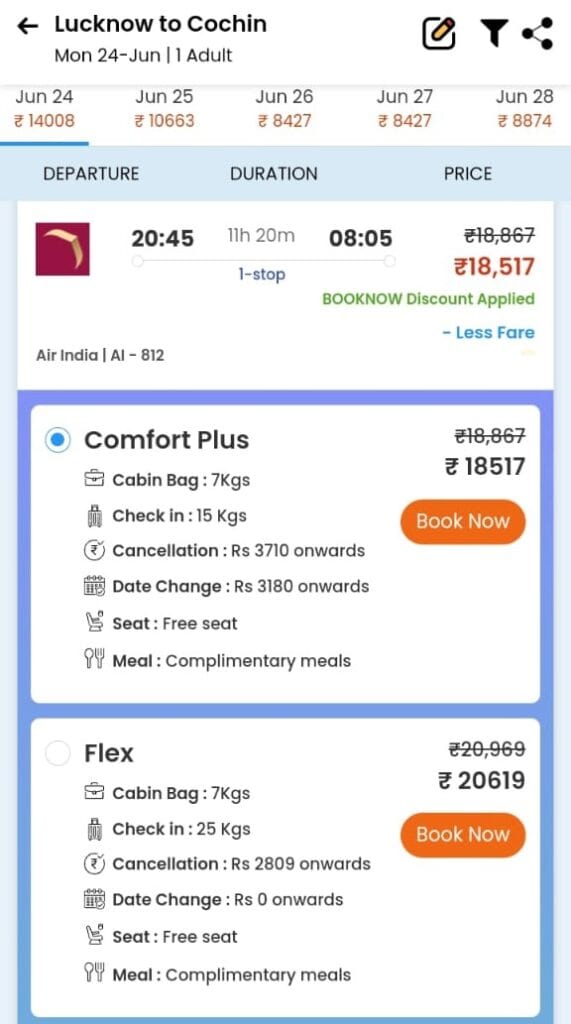

So if you book tickets on EaseMyTrip, then it would come to around Rs 18510/Person considering “Comfort Plus” plan of the “Economy Class”.

Now using the EaseMyTrip Voucher, you can only save Rs 1000.

But you must be thinking: the voucher was worth Rs 4000… then how am I eligible for the discount of only Rs 1000?

This is what I was saying.

You get 4 vouchers of total worth Rs 4000.

But unfortunately, you do not get discount of Rs 4000 in one go.

So, for your Kerela Trip, you can only redeem one of the four EaseMyTrip Vouchers, and get the total discount of Rs 1000 for booking flight.

ICICI Sapphiro Credit Card Review: Additional Perks and Benefits

In this ICICI Bank Sapphiro Credit Card Review, we have discussed about the fees and welcome benefits of this card. Let us now have a look on the ICICI Sapphiro Credit Card additional benefits.

1. LOUNGE ACCESS

I. Domestic Airport Lounge Access:

- Card users get 4 complimentary lounges access to airports in India in every three months (or quarter).

- You can get the complete list of domestic lounges here.

- This is applicable only if you spend Rs 5000 in the preceding quarter.

Example: Suppose you are planning for a journey within India in the month of April.

You want a complimentary access to one of the listed lounges.

So this can be done only if you have spent minimum Rs 5000 in the previous three months—JAN, FEB & MAR.

II. International Airport Lounge Access

- You also get 2 complimentary international airport lounges access every year through the Dreamfolks membership.

- You can get the complete list of international lounges here.

2. GOLF ROUND ACCESS

- This is one of the premium benefits offered by the ICICI Sapphiro Credit Card.

- Golf lovers can enjoy up to 4 complimentary rounds of golf every month.

- This is a spending-based benefit, and can be availed for retail spends of Rs 50000 in the preceding month.

3. HEAVY DISCOUNT ON MOVIE TICKETS

- If you are a movie lover (like me), you are going to love this credit card.

- Movie Offer: You just buy one ticket on BookMyShow (using this card), and you will get up to Rs 500 off on the second ticket.

Example: Suppose you buy a movie ticket of price Rs 400.

You want to have another ticket for your spouse/friend.

So, you will get the other one for free, and you just have to pay Rs 400 (in total).

Now, let’s suppose you want to book a VIP seat and the ticket price is Rs 600.

Here you will get a discount of Rs 500 on the second ticket and for this you will have to pay only Rs 100.

Your total spending would be Rs 700 (Rs 600 for 1st ticket + Rs 100 on 2nd ticket).

Should I get this Credit Card?

This is one of the most asked questions, and I couldn’t avoid it in the ICICI Sapphiro Credit Card Review.

I feel that most middle-class Indians may not relate with this card.

The reason is simple…

The ICICI Bank Sapphiro Credit Card is especially designed for higher net-worth individuals (HNIs).

However, I am giving some checks that will help you decide if you are a right fit to this credit card. This card is for you if —

- You travel a lot

- You want to enjoy premium lifestyle perks like Golf rounds

- You are a movie lover and want great discount on movie tickets

- You wish to have a range of welcome bonus— From shopping to booking flights and cabs

- You can afford the joining and annual fees (as they are really high)

- You’re a high-spender (only then you can get most out of this card)

Final Thoughts on ICICI Sapphiro Credit Card Review

Let us conclude this ICICI Sapphiro Credit Card Review.

The ICICI Bank Sapphiro Credit Card offers a solid blend of travel, lifestyle, and entertainment benefits.

This card is ideal for movie lovers, travellers, and high-spenders who do a lot of shopping.

However, I found ICICI Bank Sapphiro Credit Card to be less-rewarding for shopping. It might be an issue for those looking for higher returns on their spending.

Also, I personally feel that some features of this credit card is almost unreachable to middle-class fellows.

I am talking about the golf round access.

You need to spend Rs 50000 in a month (e.g. June) to get up to 4 complimentary rounds of golf in the following month (July).

What do you think? Is it achievable by a middle-class Indian in normal cases?

Also, the annual fee can be waived only if you have spent Rs 6 lakh in the previous year, which is again out of the reach of the middle class.

Overall, the ICICI Bank Sapphiro credit card offers a balanced mix of benefits that can justify its cost for the right user profile.

If you find yourself aligning with the perks and benefits mentioned, this card could be a valuable addition to your wallet.

Please comment how was the ICICI Sapphiro Credit Card Review.

See you soon!

HAPPY INVESTING!!