HDFC Bank Marriott Bonvoy Credit Card Review- 27th July 2025: HDFC Bank and Marriott Hotels jointly launched the Co-branded HDFC Bank Marriott Bonvoy Credit Card. It is titled as the “1st Co-brand Hotel Credit Card” of India.

When it was 1st launched, I was very keen to know if it truly added value, or was just another premium-looking plastic card.

But I really found it useful, especially for premium-hotel perks like free stays.

If you love staying at Marriott Hotels, it completely makes sense to use this credit card.

Here’s is the detailed HDFC Bank Marriott Bonvoy Credit Card Review.

OVERVIEW

| FEATURE | DETAILS |

| Type | Co-branded Travel Credit Card |

| Best For | Spending at Marriott Hotels |

| Reward rate | 0.8% – 3.2% |

| Joining Fee | Rs 3000 + GST |

| Annual Fee | Rs 3000 + GST |

| Annual Fee Waiver | Nil |

| Welcome Benefit | 1 Free Night Award (upto 15000 Bonvoy Points) |

HDFC Bank Marriott Bonvoy Credit Card comes at a low joining or annual fee, if you compare it with Axis Atlas. Also, since atlas is not a good choice for Marriott Hotel Bookings, you get this edge with HDFC Marriott Bonvoy Credit Card.

The reward rate typically ranges from 0.8% to 3.2% depending on the spending categories, which I will discuss later.

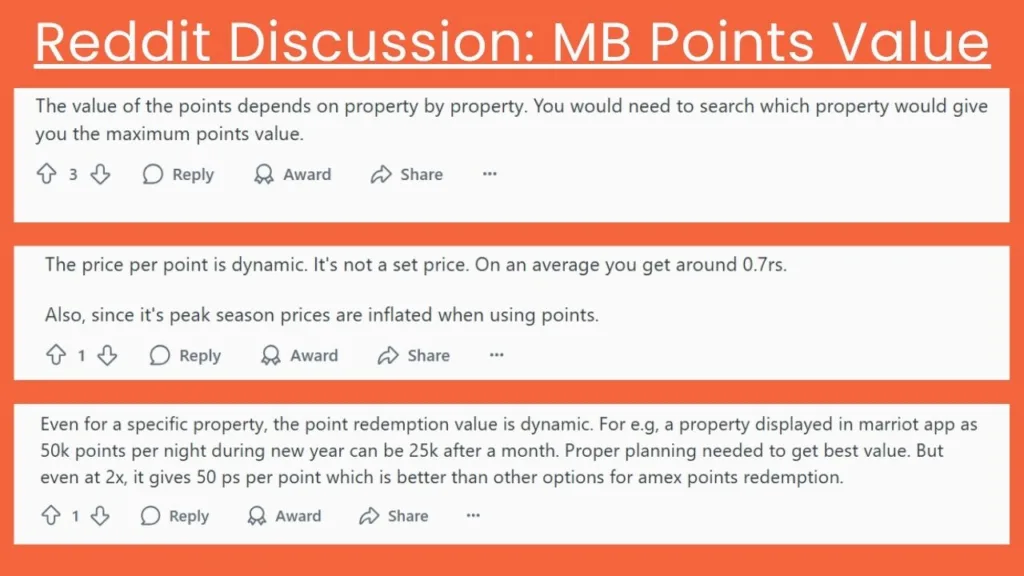

For calculating reward rate, I am taking 1 Bonvoy Point = Rs 0.6. You’ll not find a definite value of Bonvoy Point. It’s not even mentioned on their website. However, users on Reddit say that its value vary from property to property.

Now, let’s talk about the reward points and redemption process.

Reward Points on HDFC Marriott Bonvoy Credit Card: How Much Can You Earn?

| Spend Type (Non-EMI) | Base Rate | Monthly Spend Capping | Rate (spend above threshold) |

| Marriott Hotels | 8 MBP/Rs 150 | Rs 10 lakhs | 2 MBP/Rs 150 |

| Travel, Dining, or Entertainment | 4 MBP/Rs 150 | Rs 5 Lakhs | 2 MBP/Rs 150 |

| Other Purchases | 2 MBP/Rs150 | Rs 1.5 Lakhs | Nil |

This card gives you Marriott Bonvoy Points (MBP) when you use it for spending.

You earn 8 points for every Rs 150 spent at Marriott Bonvoy Hotels.

If you’re spending on things like travel, dining, or entertainment, you’ll earn 4 Marriott Bonvoy Points per Rs 150. For all other on-going spends, the rate is 2 points per Rs 150.

As you can see in the above table, each of the spend type has a monthly capping on it.

For spending at Marriott Bonvoy Hotels, the monthly capping is Rs 10 Lakhs. So, you’ll earn 8 MB Points per Rs 150 up to monthly spend of Rs 10 Lakhs. But, if you somehow go beyond Rs 10 Lakhs in a month, then you’ll earn 2 MB Points for every spend of Rs 150.

Welcome Benefits: Free Night Stay and Silver Elite Status

As a welcome benefit, cardmembers get complimentary Marriott Bonvoy Silver Elite Status, 1 Free Night Award, and 10 Elite Night Credits. Let us discuss each one of them in detail.

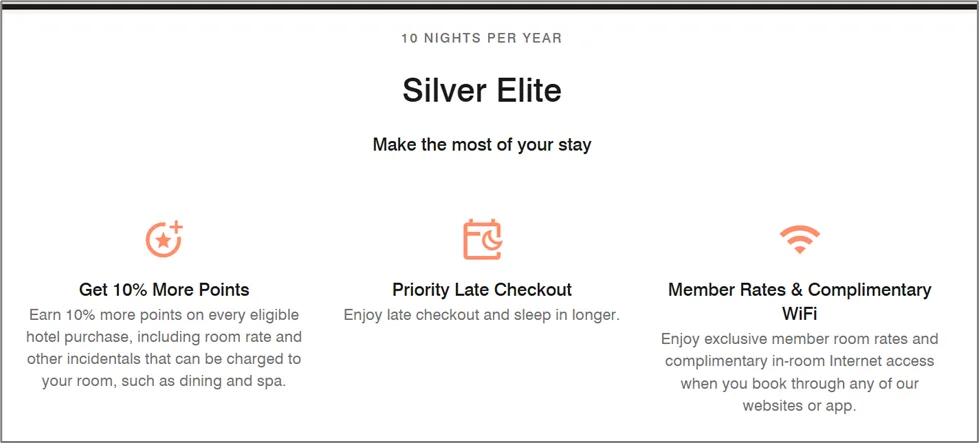

1. Marriott Bonvoy Silver Elite Status

Marriott Bonvoy is a free-to-join hotel loyalty program by Marriott International. There are total 6 membership levels. “Member” is the base tier, while other five are elite statuses. Each level has been divided based on the number of nights you stay at Marriott Hotels. Here is the details-

- Member: 0 to 9 Nights/Year

- Silver Elite: 10 Nights/Year

- Gold Elite: 25 Nights/Year

- Platinum Elite: 50 Nights/Year

- Titanium Elite: 75 Nights/Year

- Ambassador Elite: 100 Nights/Year + Annual Spend of $23,000 USD (~ 19 lakhs)

So, normally you need to stay at least 10 nights at Marriott hotels in a year to get Silver Elite Status.

But with the HDFC Marriott Bonvoy Credit Card, you automatically get this status for free.

However, to be honest, silver elite status does not come with great benefits. Here are the major advantages of this membership:

- 10% bonus points on hotel spends

- Priority Late Checkout

2. Free Night Award (FNA)

You also get 1 Free Night Award on your 1st eligible purchase or payment of the annual fee.

Free Night Award can be applied for one night stay at any Marriott Bonvoy Hotels, with a redemption value of up to 15000 points.

Suppose you’ve chosen a hotel room with 11,000 points/stay. Now, you’ve two options: either use 1 Free Night Award or book only using available points in your account.

But, if you choose Free Night Award, you’re not redeeming the full 15000 points. In that case, the unused 4000 points will not be re-credited to your account and so you’ll lose all the 15000 points.

Therefore, it’s a better option to go only with points in such a case, (considering you’ve sufficient points balance)

However, if hotels are demanding 15000 or more points for a night stay, you get the option to combine FNA with additional points.

You can combine your Free Night Award with up to 15000 additional Marriott Bonvoy Points. This allows you to book hotels with up to 30,000 points per night stay.

For example, let’s say you want to book a hotel with 20,000 points/stay. So, you can simply use 1 FNA + additional 5000 points from your account to book the hotel.

Free Night Award is credited to your account on every anniversary year within 6 weeks of paying the annual fee. Each of them has a validity of 1 year.

3. Elite Night Credits

Cardmembers also receive 10 elite night credits every year, which can help them reach even higher membership levels with Marriott.

This is also credited within 6 weeks of the annual fee payment. But they get invalid on 31st December each year.

MILESTONE BENEFITS

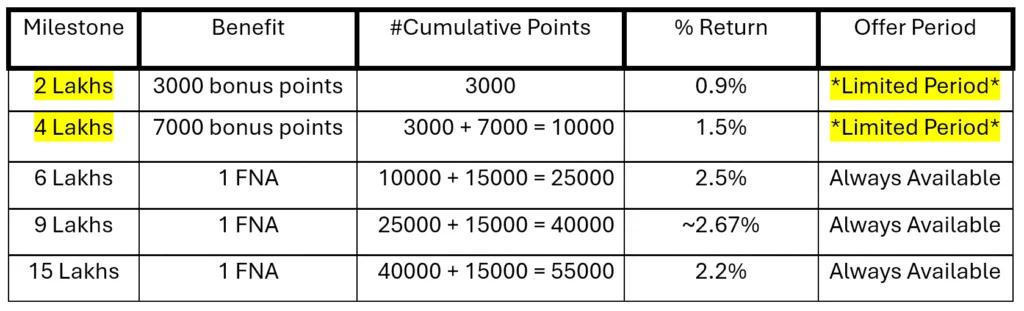

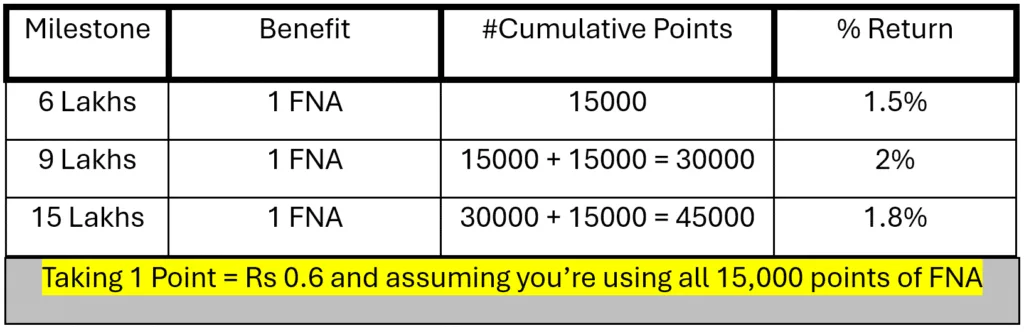

Milestone benefit of 2 lakhs and 4 lakhs have been recently added and is a *Limited Time Offer*. This offer is valid from 1st March 2025 to 31st August 2025.

Normally, milestone benefit begins at a spend of 6 lakhs.

But, with this limited period offer, you can grab milestone benefit even with spending 2 lakhs. Moreover, you can add some extra return.

Let us know about the Milestone Benefit, in usual.

At each milestone, you get an additional Free Night Award (FNA) with redemption level up to 15000 Points.

So, combining welcome benefit, you can receive up to 4 FNA with HDFC Marriott Bonvoy Credit Card.

LOUNGE ACCESS

| LOUNGE TYPE | # NO. OF VISTIS/YEAR |

| Domestic (within India) | 12 |

| International (outside India) | 12 |

You get 12 lounge visits within India and 12 visits outside India every year. However, unlike other card, you don’t need to meet any spend criteria for this benefit. This is a good news for travellers.

Who Should get this Credit Card?

This card is a solid option for someone who love staying at Marriott hotels.

It’s also best for people who like to plan holidays around hotel points. If you’ve ever enrolled for hotel loyalty programs, you know how satisfying it feels to book a Rs 10,000/night room without paying a rupee.

But, to be honest, if you prefer other hotel chains, you are not going to get the most of this card.

Also, if you are looking for a decent cashback on grocery or everyday spending, you can skip right away. In such case, you can consider SBI Cashback Credit Card, which is a more reliable option in these categories.

ELIGIBILITY

| Criteria | Salaried | Self-Employed |

| Age | 21 – 60 Years | 21 – 65 Years |

| Income | > Rs 1 Lakh per Month | ITR > 15 Lakhs per Year |

| Nationality | Indian | Indian |

If you are totally fine with this eligibility criteria, you can apply using this link on HDFC Bank Website.

BOTTOMLINE

Overall, HDFC Marriott Bonvoy Credit Card is a great pick for travellers, especially who stays a lot at Marriott hotels.

We get a decent average cashback of 3.2% on hotel bookings at Marriott. The immediate silver status and free night stays also make it notable for hotel bookings.

Other than hotel perks, I also loved that we don’t need to chase for domestic or international lounge visits. There is no spend criteria.

However, it really fails to offer good reward rate on everyday spending.

Monthly income of 1 lakhs+ can also be problematic for most individuals. It’s totally revealing the bank’s intention to target high-income customers with a “potential” to spend on their ecosystem.

This was all about the HDFC Marriott Bonvoy Credit Card Review.

I tried my best to put together all possible details, so that you can take wiser decision.

Please comment your valuable thoughts about this post, or anything I missed out.

Till then,

Happy Saving