Is Gold a Worth-it Option for Investment: There has been a unique relationship between gold and Indian traditions for ages. The charming beauty and integrity of this metal have won the hearts of millions of Indians.

The use of gold in India has not been limited to a medium of exchange. It has been more than just an asset for the Indian society. This comprehensive guide would help you in deciding whether you should look for gold as an investment or not. Let us discuss in detail.

Whether you talk about temples or weddings, gold is the pride of every ceremony. People consider it as a symbol of prosperity and royalty in India. They never miss any occasion to show off their gold ornaments and thus their richness (especially women…jokes apart😉).

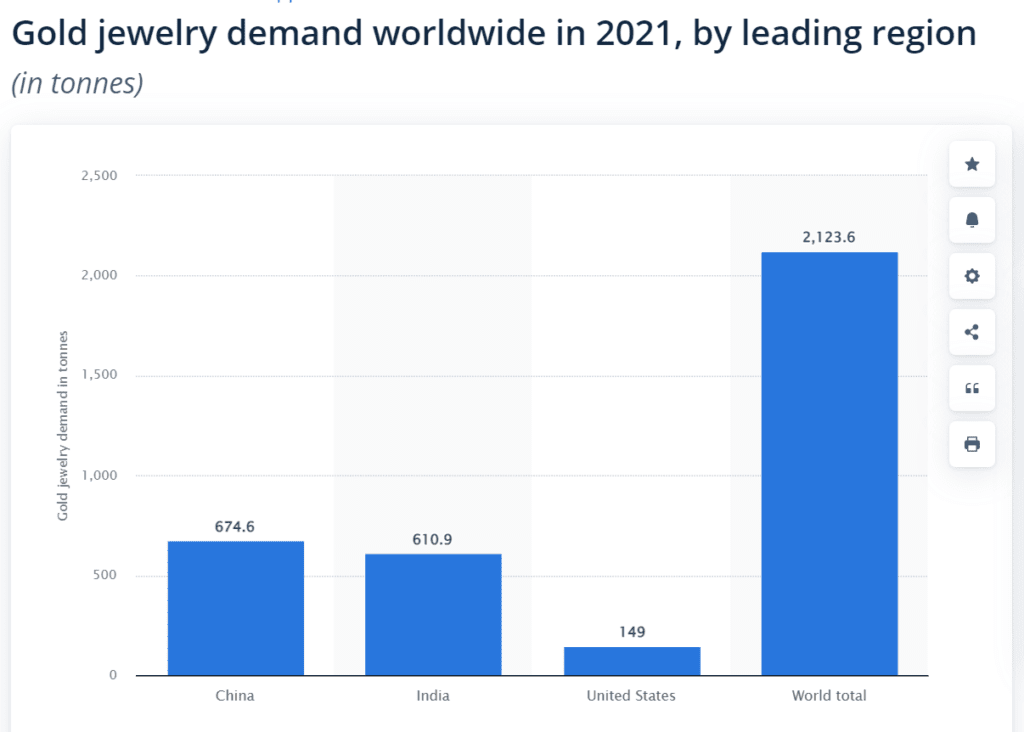

According to the World Gold Council, India was ranked second in the world for Gold Jewellery Demand in 2021.

As you can see in the above graph, India is second only to China.

However, apart from the sentimental appeal, does gold as an investment make economic sense?

In this article, I am going to share some of the main reasons why you should have gold in your portfolio.

Let’s get started!

Why Should I Look for Gold Investment?

Here are some of the reasons to consider gold for investment:

1. High Liquidity

Gold offers high liquidity to the investors. You can buy or sell gold with ease anywhere in the world.

The liquidity of an asset becomes important in situations when you need immediate cash. In such a case, assets like land may pose a challenge.

This is not the case with gold.

Whether you buy Gold in the physical form or as a digital asset, you will not face any problem while selling it.

2. Safeguard Against Inflation

We know that Inflation lowers the purchasing power of the Currency. As a result, it has a negative impact on the returns of investments such as stocks, bonds, etc.

Owning gold, on the other side, can act as a hedge against the rising inflation. This is because gold belongs to the commodity market and follows the inflation rate.

As a result, the gold price goes up whenever there is a hike in inflation.

3. High Returns

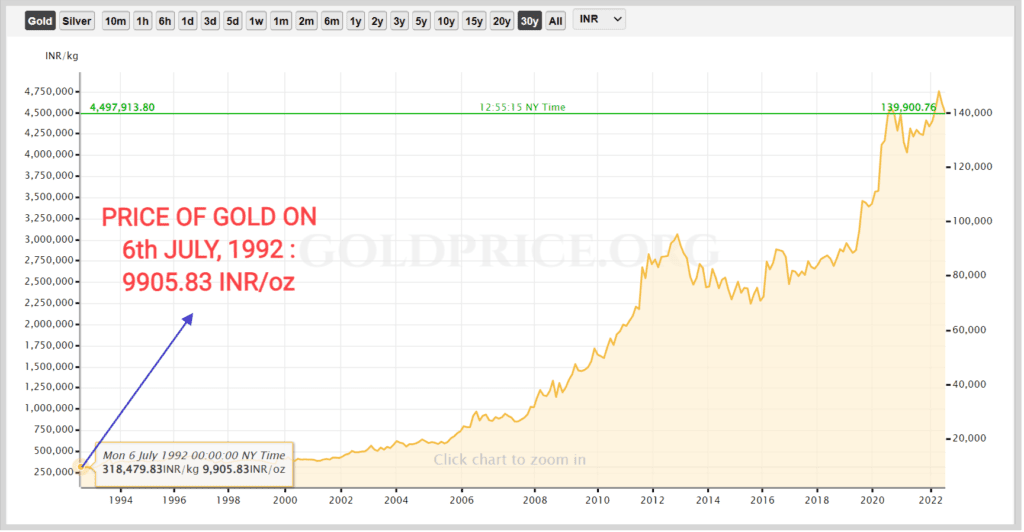

Gold can provide high returns if you can hold it for a longer duration of time (say 20 or 30 years).

Furthermore, gold is a paperless asset that only needs to be kept in a safe locker.

This is a 30 Year Gold Price Chart. Here you can see that the price of Gold on 6th July, 1992 was Rs 9905.83/oz.

Please note that oz is a common abbreviation for Ounce (a unit of weight) and 1 oz is approximately equal to 28.35 grams.

Now suppose you had bought only 1 ounce of gold bar at Rs 9905.83 and kept it in a safe for 30 Years.

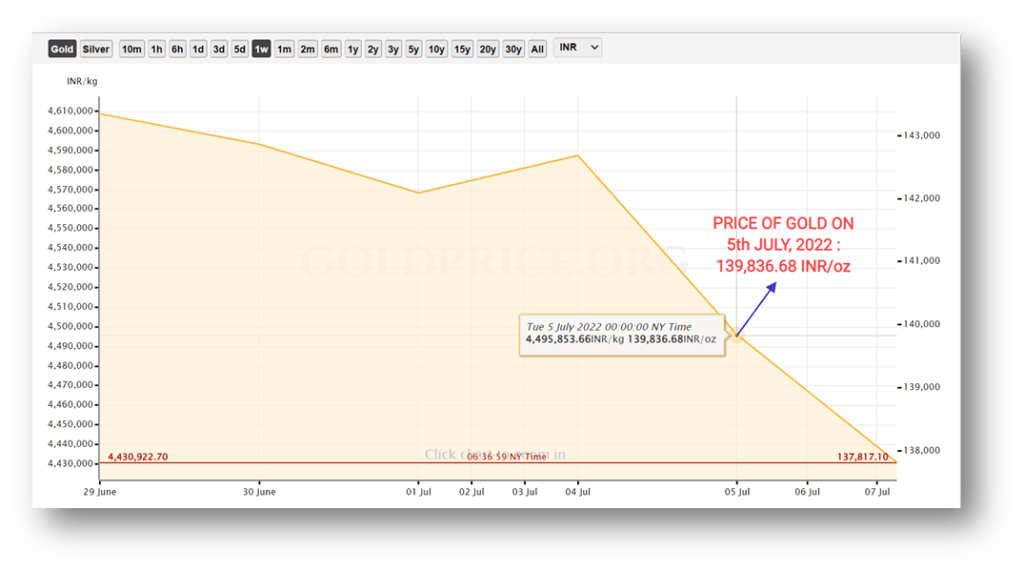

Let us have a look on the current gold investment price.

As you can see the price of 1 ounce (oz) of gold is Rs 139,836.68 on 5th July, 2022.

This means that your investment grew from Rs 9905.83 to Rs 139,836.68 over the period of 30 years. Its Compound Annual Growth Rate (CAGR) is 9.23%.

The funny thing here is that you didn’t have to do anything to make such a huge profit of 9.23 %. The entire process was paperless (for physical gold) and you were able to lock profit by beating inflation.

Long story short, you can earn high return on your gold investment if you would hold it for longer time duration.

3. Wide Range Of Gold Investment Options Available

Credits: Getmoneyrich.com

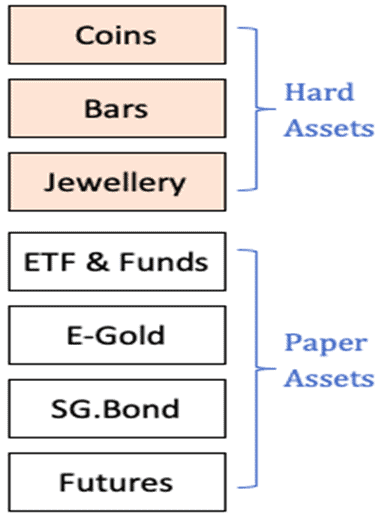

There are a variety of options to choose from while investing in gold. They can be classified into two major groups:

- Physical/Hard Asset: This includes gold bars, coins, jewellery, etc.

One of the biggest benefits of owning gold as hard asset is that you need zero or a minimum paperwork. Unlike paper assets like stocks or bonds, you do not even need to open a Demat or trading account to hold physical gold.

However, if you are intended to invest in gold, I would suggest you to buy gold bars or gold coins for investment. You can buy gold bars and gold coins from bank or also from a jewellery shop.

Why not Jewellery🤔?

The reason for this is that in the case of jewellery, you will have to pay making charges in addition to the original gold price and 3% GST. Such charges are not levied on gold bars and gold coins.

Quick Note:

It is the cost that the buyer has to pay for the making and designing of jewellery from raw gold. Making Charges on gold jewellery in India ranges from 3% to 25%.

- Digital Gold- You can also buy gold online in the form of digital asset such as E-Gold, Gold ETFs and Gold Mutual Funds, Sovereign Gold Bond (SGB), etc.

In comparison to physical gold, you get an added advantage of safety and purity on buying gold online.

Final Words🗣️…

Everything in this world has both positive and negative aspects. Gold is also one of them.

Looking into positive part, we can say that gold has ability to provide high liquidity, high returns and also hedge against inflation.

We have also seen how one can beat inflation and lock profit by only keeping gold in a safe locker. We do not get such advantage with cash as they get devalued over time due to inflation.

If you look into the negative side, one may face problem in storing physical gold. As you know, gold is a priceless asset, and protecting it from theft is a challenge!

We also discussed how we can remove the problem of safety and purity of gold by investing online.

This was all about the article.

I hope this guide would have given you a wider perspective on whether gold investment is good or bad.

In the meantime, if you have any query or suggestions for the post, you can share with me in the comment section.

Good Day!

Cheers👌