Most people consider credit card as means of overspending and piling up debt.

But have you ever thought of using credit card as a money-saving tool?

You read that right!

We can follow some credit card hacks to use it in our favour and saving money every month.

I am going to discuss 10 powerful credit card hacks for saving money every month.

Understanding the Fundamentals of Your Credit Card

Before jumping into tips to save money with credit cards, it is important to understand the basic features of your credit card.

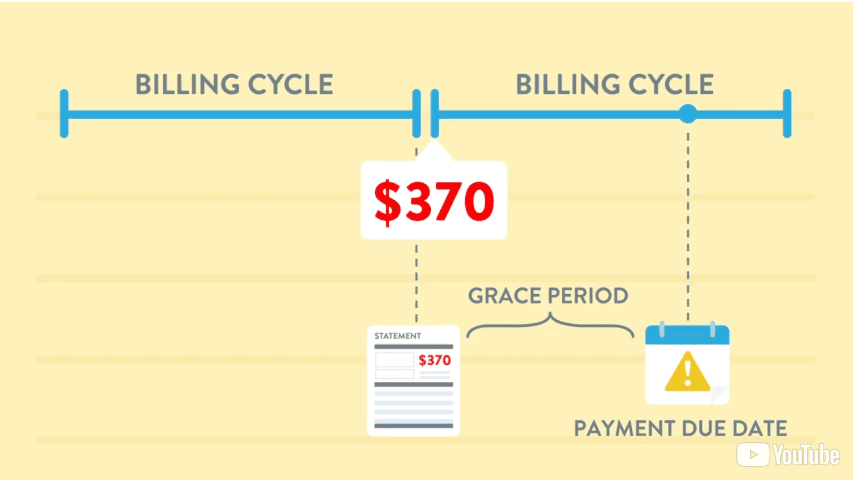

You need to be familiar with components such as interest rates, billing cycles, grace periods, and credit limit.

- Interest Rate: Interest rate is the cost you pay for borrowing money from the card issuers. This is important to know because more cost is incurred if you carry a balance with a higher interest rate.

- Billing Cycle: The billing cycle is the timeframe from one statement’s closing date to the next.

- Grace Period: Grace Period is the time during which we can pay off our balance without paying any interest. It also known as the interest-free period. A lot of money can be saved as interest charges if you know when it is not charged.

Understand Your Spending Behaviour

Before choosing a card, you can take some time to understand your spending behaviour.

I know you may not have encountered this term before in your life. But it has an important role to play when it comes to saving money with credit cards.

How do I know my Spending Behaviour?

There are two simple rules which I follow—

Track your expenses

We spend our money on a lot of things. This may be shopping, utility bills, gas, dining-out, entertainment, or transportation cost. [ I know the list is still short 🙂 ]

Now, firstly you have to divide your expenses into such categories—a few I mentioned above.

Then you need to figure out where and how much you are spending every month.

Is it really important?

I know it’s not an easy task to take care of where your money goes every month (I also hated this!).

But inculcating this small habit will give you control on your spendings, and you will think twice before making unnecessary purchases!

Analyse Your Spendings

After tracking expenses for a few months, it’s time to analyze your spending behaviour.

You can now easily highlight categories where you spend the most money. It can be anything. You may have been spending on transportation a lot or dining-out may have been the significant part of your lifestyle.

However, these patterns may vary over time, and analyzing this will help you find a card suitable to your needs.

Choose the Right Card

It is a bit overwhelming to find a right card that suits your spending habit.

You can look for cards that are offering cashbacks, or discounts on your regular purchases. For example, if you are a foodie, you may want to choose a card giving cashbacks or rewards on dining purchases.

Also, consider factors like joining and annual fees, interest rates, credit limit, and rewards programs before taking a decision. These details can make a big difference in how much the card is going to be beneficial.

Don’t just settle for the first card you see. Credit cards of the same type from different banks should be compared to find the best rewards and benefits. Online tools and comparison websites can be really helpful for finding out how different cards measure up against each other. They make it easy to spot the best deals.

Avoid Unnecessary Fees

It’s important to know the fees associated with your credit card.

Credit card comes with a lot of fees such as joining fees, annual fees, late payment fees, foreign transaction fees, etc. You should be mindful of such fees as they can add up quickly and eat your savings. Therefore, it is advisable to check the fees associated with a credit card before choosing it.

If you make occasional credit card purchases, you may want to consider the Lifetime Free Card (LTF) option. These cards do not charge joining and annual fees and you can avoid paying it every year.

Pay Your Balance in Full and On Time

We can save a lot of money by paying our bills on time and avoid the interest charged on it.

Banks charges a high-interest if you fail to pay your bills before the due date. This is also known as finance charges.

You may also have to pay late payment fees based on the outstanding balance.

When you miss paying bills on time, all the new purchases with your card become eligible for interest charges. These new bills will be added to your total balance, and interest will be charged daily on the entire amount until you pay it off in full.

So, how we can overcome that?

The answer is simple.

You must pay your bills in full before the due date.

As a result, you avoid getting into debt and save a lot of money on interest charges every month.

Take Advantage of Welcome Bonuses

One of the easiest credit card hacks for saving money every month is taking advantage of signup bonuses.

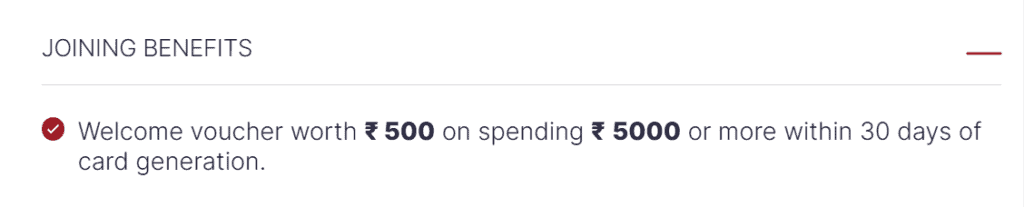

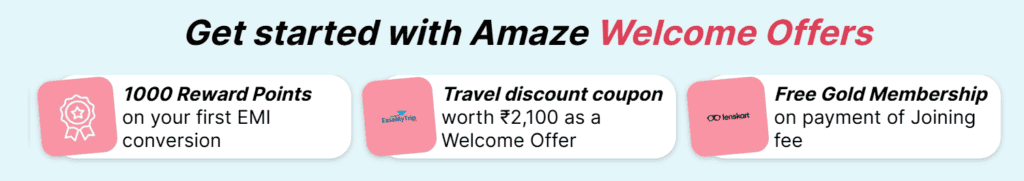

Banks or card issuers offer welcome bonus to its new cardholders. This is usually done for promotion and add more customers.

However, welcome bonuses are normally provided when you meet certain spending-based condition within a specific period (say 3 months).

These sign-up bonuses can be of various forms, such as travel credits, cashbacks, coupons, or free membership on partner merchants.

You need to keep an eye out for these welcome benefits, and redeem them before the offer expires.

Use Your Rewards Wisely

You get rewards (or cashbacks) on purchasing from credit cards.

But every credit card has different rewards program, and using them in your favour is an art.

Some cards give more cashback on online shopping, while others offer more on offline spends.

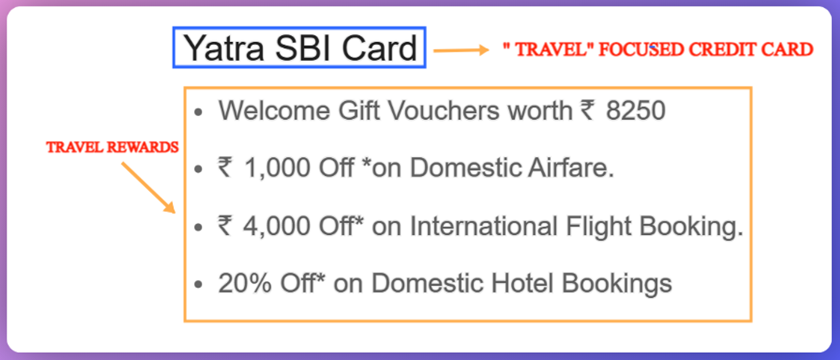

Most cards are category-specific and is designed to give more benefits only to a certain category. For example, cashback credit cards are most rewarding for shopping.

Similarly, cards designed for “travelling” offers more reward or discount on booking flight tickets, cabs, or hotels.

Disclaimer: This image is not promoting any Bank’s credit card. This has only been used for educational purposes.

It is important to be aware of your spending behaviour, and use the credit card accordingly to maximize your monthly savings.

Consider a Balance Transfer

Balance transfer is one of the smart smartest credit card hacks for saving money every month by reducing the interest costs.

If you own multiple credit cards, you can consider transferring your balance (or credit card bills) to another card having comparatively lower interest charges.

This would allow you to save money by paying lower interest on your bills using another credit card.

Moreover, many card issuers offer introductory 0% APR Period on purchases or balance transfers. According to Forbes, the 0% APR Period typically ranges from 6 to 24 months (depending on the bank).

During this period, you do not need to pay interest on your credit card bills.

So, transferring your balance to card that offers 0% APR can be a wise move to save money on interest charges. This will also enable you to pay off your debt faster.

Tips: Make sure to pay your bills before the period ends. Otherwise, interest will be charged on further purchases.

Stay Vigilant Against Fraud

According to a 2021 annual report, about 127 million Americans (50%) have been victims of credit card theft at least once. (Source: Wikipedia)

Credit card fraud is a sad reality. But it is important to stay vigilant against it and protect your hard-earned money.

You need to regularly monitor your credit card statements and report any suspicious activity as soon as possible. Many cards offer a “fraud alert” feature that notifies you of large transactions or unusual spending patterns. You can sign up for these alerts to always be one step ahead of fraudsters.

Also, use safe websites and avoid sharing credit card information via email or unsecured connections.

Taking these small—but important precautions can prevent you from fraud and save money in the long run.

Maintain a Good Credit Score

You must be guessing “what’s the need of credit score in saving me dollars!”

But a good credit score can open doors to better loans and credit card offers.

According to NerdWallet, you’ll typically need a score of at least 690 (FICO Scale) to qualify for most 0% APR Credit Cards.

Also, you can easily negotiate with your bank for higher credit limits and lower interest rates.

Now, how to maintain a good credit score?

If you like to-the-point advice, try to pay your bills on time, and maintain a low credit utilization ratio.

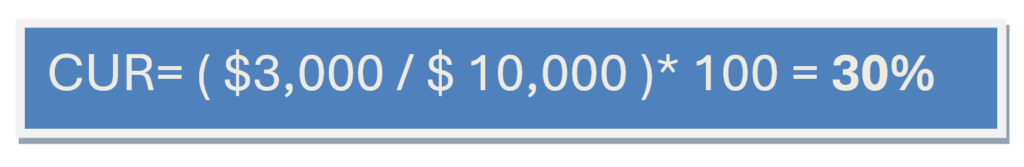

It is advisable to keep your credit utilization ratio below 30% of the credit limit. For example, Let you have a credit card with total credit limit $10,000. Let us suppose that your total credit card balance is $3,000. Then, the credit utilization ratio can be calculated by dividing the total balance with the total credit limit.

CONCLUSION

Credit cards don’t have to be a financial burden. We can use them to save money, earn rewards, and improve our financial health.

I discussed all the credit card hacks for saving money every month you swipe it.

Let us quickly wrap-up. You need to choose a card that aligns with your spending behaviour, take advantage of welcome bonuses, and use your rewards wisely (get the most value).

Credit cards has lot of fees, and you should always check them properly before selecting a card.

If you own multiple credit cards, you can transfer balance to another card to save money on interest cost.

Paying all your bills on time should be a part of your lifestyle. You may set up automatic payments or reminders to ensure you never miss a due date.

Last but not the least— maintain a good credit score and review your credit statements regularly. This will keep you away from the reach of fraudsters! I hope you have learned how credit cards can also be used as a money-saving tool. Following these tips with sincerity not only allows you to save money, but also to become credible in the “eyes of banks”.