Best Credit Cards in India With No Annual or Joining Fee: Lifetime free credit cards are always in demand.

The reason is simple and hidden in the name itself .

They are free.

And you do not have to pay any kind of joining or annual fee from your wallet.

But…

You must understand one thing about lifetime free credit cards.

They provide fewer premium perks to the cardholders.

(Only one credit card on this list gives you access to international airport lounges🥲)

I have carefully compiled this list keeping in mind the diversity, ease of use, and annual income. I have made sure that these lifetime free credit cards match everyone’s needs and preferences.

You’ll find credit cards that give offers on movies, shopping, grocery and utility bills, travel, and more.

Let us have a look on the 8 best credit cards in India without any annual or joining fee [Zero Fee].

1. Amazon Pay ICICI Credit Card

Best for: Amazon Shopping

Amazon Pay ICICI Credit Card is one of the best Credit Cards in India for shopping with no annual or joining fee. You get rewarded every time you pay your bills using this card.

Key Benefits:

- This card is lifetime free i.e., you do not have to pay any kind of joining or annual fee.

- There is no upper limit on the rewards you can earn using this card.

- If you are an amazon prime member, you can earn 5% cashback on all your shopping from Amazon. You get 3% cashback if you are a non-amazon prime member.

- If any kind of payment is made using this card on Amazon Pay, you will be rewarded with 2% cashback.

- You can earn 1% cashback on all other spendings (off amazon) such as shopping, dining, insurance premiums, etc.

- You also get a welcome bonus worth Rs. 2000 and free amazon prime membership for three months.

2. IDFC First Select Credit Card

Eligibility: Annual Income of Rs 12 lacs or more

Best For: Shopping

IDFC First Select Credit Card is another Card in the lifetime free Category with a variety of features and benefits. You are eligible to become a cardholder of this credit card if you have an annual income of Rs 12 lacs or more.

Key Benefits:

- No Joining or annual fee

- You get 3X reward points on shopping till Rs 20,000 in a billing cycle (typically ranges from 25 to 31 days but may be shorter depending on the card issuer). This means you can earn 0.5 % cashback on spending up to Rs 20,000 using this card.

- You earn 10X reward points (around 1.5% cashback) on spending beyond Rs 20,000 within a billing cycle.

- You get a welcome bonus worth Rs 500 on spending Rs 5000 or more within 30 days of getting the card.

- You can also avail 5% cashback (up to Rs 1000) on paying your first EMI (using this card) within 30 days of receiving the card.

- This credit card also offers domestic airport and railway lounge access. You can avail 2 complimentary domestic airport lounge access in every three months (8 visits per year) on spending minimum Rs 20,000 every month. If somehow you are unable to spend Rs 20,000 in any month (say June), you will not get this benefit in the following month i.e., July in this case.

- You also get 4 complimentary railway lounge access in every three months.

- If you are a movie lover (like me), this card has also got you covered! You can avail “Buy One, Get One” offer on buying movie tickets from the Paytm App using this card. If the ticket cost is Rs 125 or less, you can get the 2nd ticket for 100% free and you need to pay only for the 1st ticket. You can get this benefit only twice a month and save up to Rs 250 on movie tickets every month.

3. BOB Prime Credit Card

Bank of Baroda (BOB) Prime Credit Card is a lifetime free credit card that can be issued against a FD of Rs 15000 (or more). Also, you do not have to show any income proof i.e., no ‘eligibility’ condition on the income.

BOB Prime Credit Card does not come with a lot of benefits (like most other cards in the ‘LTF’ category).

So, if you need a lifetime free credit card and also want to make fixed deposits, you can choose this card.

Key Benefits:

- No annual or joining fee.

- You do not need to show any income proof.

- You can earn 1 Reward Point (1 RP = Rs. 0.25) for every Rs 100 spent on select MCCs and 2 Reward Points for every Rs 100 spent on all other MCCs i.e., 0.5% cashback.

- You get 1% fuel surcharge waiver on all your fuel payments between Rs 400 – Rs 5000. You can avail a maximum waiver up to Rs 250 per month.

- The cardholders also get an “Easy EMI” option where they can easily convert their spendings of Rs 2500 or above into an EMI of 6 to 36 months (as per their convenience).

- Other benefits include Free Add-on card, In-built insurance cover, Zero liability on lost card, and more.

4. IDFC First Wealth Credit Card

IDFC First Wealth Credit Card is another lifetime free card by IDFC bank with premium features. You are eligible to become a cardholder of this credit card if your annual income is Rs 36 lacs or more.

Key Benefits:

- The cardholders can earn 3X Reward Points (0.5% cashback) on spending up to Rs 20,000 in a billing cycle.

- You get 10X Reward Points (around 1.5% cashback) on doing shopping of above Rs 20,000 in a billing cycle.

- You get a Joining bonus worth Rs 500 on spending Rs 5000 or more within 30 days of getting the card.

- You can earn 5% cashback (up to Rs 1000) if you pay your 1st EMI using this credit card within 30 days of getting the card.

- This card is amazing for movie lovers😎. You can avail “Buy One, Get One” offer on buying movie tickets from the Paytm App using this card. If the ticket price is Rs 250 or less, you can get the 2nd ticket for 100% free and you need to pay only for the 1st ticket. This benefit can be availed only twice a month i.e., you can save up to Rs 500 on movie tickets every month. Amazing, right?

- This card also offers premium benefits to the travelers including lounge and spa visits. You can get 2 complimentary domestic airport lounge plus spa visits and 2 complimentary international airport lounge visits in every three months. This benefit can be activated in the following month (e.g., June) if you have spent Rs 20,000 (or more) in the previous month (May).

- You can also access 2 complimentary golf rounds every month on the same condition as stated above.

- Cardholders can also avail 4 complimentary railway lounge visits in every three months.

- You also get 1% fuel surcharge discount (up to Rs 400 per month) on all fuel purchases between Rs 200 to Rs 5000.

- Low Forex markup charges of 1.5% on international transactions.

5. BOB Easy Credit Card

BOB Easy Credit Card is the best card for beginners with amazing offers on grocery and movie tickets.

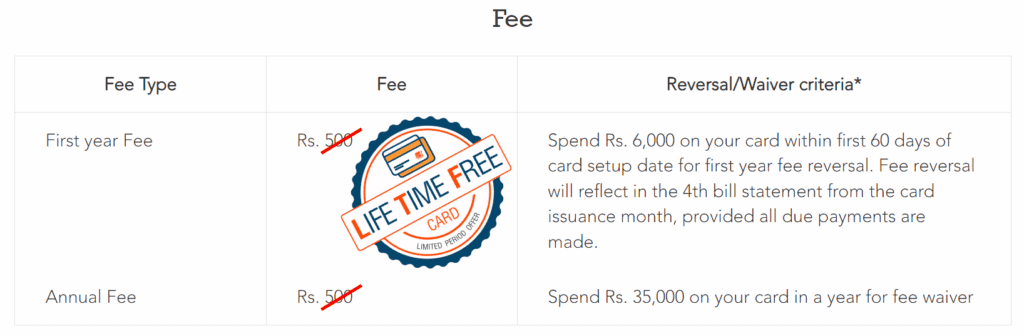

This card was available for lifetime free before 31st March, 2022.

But…

Due to rising demand of this card, the bank decided to offer a “Spend-based Waiver” rather than giving it for free.

Now, you have to pay Rs 500 for joining and Rs 500 for the annual fee.

But… Here is the deal!

If you spend Rs 6000 within 60 days of receiving the card, you will get a waiver on joining fee and it will be refunded in your bank account.

Similarly, you get an annual fee waiver on spending Rs 35000 in a year. (refer the SC below)

Key Benefits:

- The cardholders can earn 5X Reward Points (1.25% Cashback) for spending on categories like groceries, movie tickets, and departmental stores.

Note: If you have crossed 1000 reward points in a month, the rewards on these categories will drop to 1X.

You will get 1X reward points instead of 5X on further spend on groceries, movie tickets, and departmental stores.

- The cardholders get a 1% fuel surcharge waiver for payment between Rs 400 to Rs 5000 at all fuel pumps in India. You can get a maximum benefit of Rs 250 in one billing cycle.

- You get multiple redemption options to redeem your earned reward points into cashback and other options.

- You also get an “Easy EMI” option where you can easily convert spendings of Rs 2500 (or more) into an EMI of 6 to 36 months. This gives you the convenience to shop in full pay in parts!

- Other benefits are free Add-on card, zero liability on lost card, etc.

6. IDFC First Millenia Credit Card

Eligibility: Annual Income of Rs 3 Lacs or more

IDFC Millenia Credit Card is another lifetime free card in the list – Best Credit Cards in India with No Annual Fee. It is best suited for middle-class Indians.

Key Benefits:

- No Joining or annual fee.

- No cap or upper limit on the reward points.

- You get 3X reward points (0.5 % cashback ) on spending up to Rs 20,000 in a billing cycle. You can earn 10X reward points (around 1.5% cashback) on spending beyond Rs 20,000 within a billing cycle. You also get 10X reward points for shopping on your birthday.

- You get a welcome voucher worth Rs 500 on spending Rs 5000 or more within 30 days of getting the card.

- You can earn 5% cashback (up to Rs 1000) on paying your 1st EMI using this credit card within 30 days of getting the card.

- This credit card offers only Railway Lounge visits. You get 4 complimentary railway lounge access in every three months.

- You also get complimentary (free-off cost) roadside assistance worth Rs 1399.

- The cardholders get a 25% discount (up to Rs 100) on buying movie tickets from the Paytm mobile app using this credit card.

- 1% Fuel Surcharge waiver at fuel stations in India for payment between Rs 200 and Rs 5000 using this credit card. You can avail a maximum benefit of Rs 200 in a single month.

- You can convert all purchases above Rs 2500 into easy & convenient EMIs from your mobile app.

7. IDFC First Classic Credit Card

IDFC First Classic Credit Card is another best credit cards in India for which you do not have to pay any joining or annual fee.

It offers the same benefits as that of the IDFC First Millenia Credit Card (only design is different 😃).

You can have either Millenia or Classic or both credit cards in your wallet as they are absolutely free.

8. ICICI Platinum Chip Credit Card

Eligibility: Any person above 23 years old can apply for this card.

Best for: Daily Spendings

ICICI Platinum Chip Credit Card is the lifetime free card offered by the ICICI Bank. You do not have to pay any kind of joining (1st year fee) and annual fee (2nd year onwards) for this credit card.

Key Benefits:

- No joining fee and no annual fee

- You get 2 Reward points (Rs 0.50) on every Rs 100 spent on retail and grocery purchases other than fuel.

- You get 1 Reward Points (Rs 0.25) on every Rs 100 spent on utilities bills (e.g., water bill, electricity bill, etc.) and paying insurance premiums.

- The cardholders also get a 1% fuel surcharge discount at all HPCL Fuel Pumps in India for payment of up to Rs 4000.