Looking for the best credit card for online food delivery in India?

You have landed at the right page!

These days, most of us order food online more than we cook at home. It has become a part of daily routine for most of us.

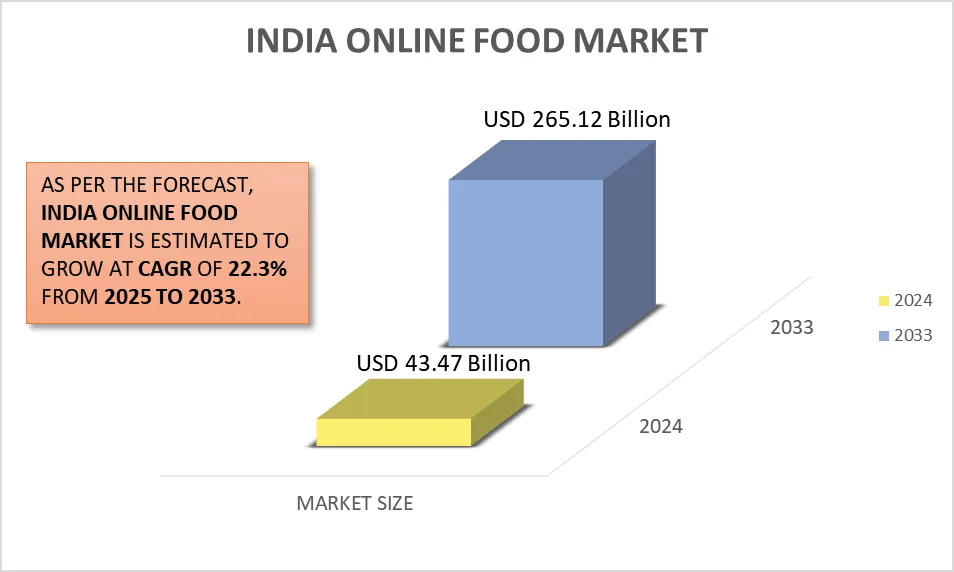

The Online Food Delivery market in India is estimated to reach $ 265.12 billion by 2033 from $43,47 billion in 2024, according to a report by Research and Markets.

Whether it’s a weekend pizza night, or just those late-night cravings— apps like Swiggy, Zomato, and Dominos have made life easy.

But here’s the thing: if you’re already spending money on food delivery, then why not save some cash while doing it?

Some credit cards give you great discounts, cashback, or reward points every time you order online.

And if you pick the right one, those savings can really add up over time.

Let us have a look on the 5 Best Credit Card for Online Food delivery in India.

5 Best Credit Card For Online Food Delivery in India

1. Swiggy HDFC Bank Credit Card

What I Loved: 10% cashback on Swiggy Spends

Swiggy HDFC Bank Credit Card is one of the best choices for online food delivery in India.

It comes with a joining and annual membership fee of Rs. 500— a small amount when you consider the kind of benefits the card offers.

If Swiggy is your go-to-app for food delivery, this card can save you a good amount each month.

KEY BENEFITS:

- You get 10% cashback on all Swiggy Spends–food ordering, grocery delivery, or dining out. However, a capping of Rs 1500 is set in each billing cycle.

- 5% Cashback on online spends with top brands like Amazon, Flipkart, Myntra, Uber, 1MG, and more. (Capping of Rs 1500 per billing cycle)You also get Swiggy One Membership for 3 months [Value-Rs 1199] on card activation.

- You also get Swiggy One Membership for 3 months [Value – Rs 1199] on card activation.

2. HSBC Live+ Credit Card

What I Loved: 10% Cashback on dining, food delivery, and grocery spends.

HSBC LIVE + CREDIT CARD is a cashback credit card known for amazing benefits on dining, shopping, and entertainment. You can apply for this card if—

• You’re 18-65 Years old

• Annual income is minimum Rs 4,00,000 (INR 4 lakhs per annum)

• You are an Indian resident living in Chennai, Gurgaon, Delhi NCR, Pune, Noida, Hyderabad, Mumbai, Bangalore, Kochi, Coimbatore, Jaipur, Chandigarh, Ahmedabad, or Kolkata.

KEY BENEFITS:

- 10% Cashback [Up to Rs 1,000 per month] on dining out, online food delivery, and grocery spends.

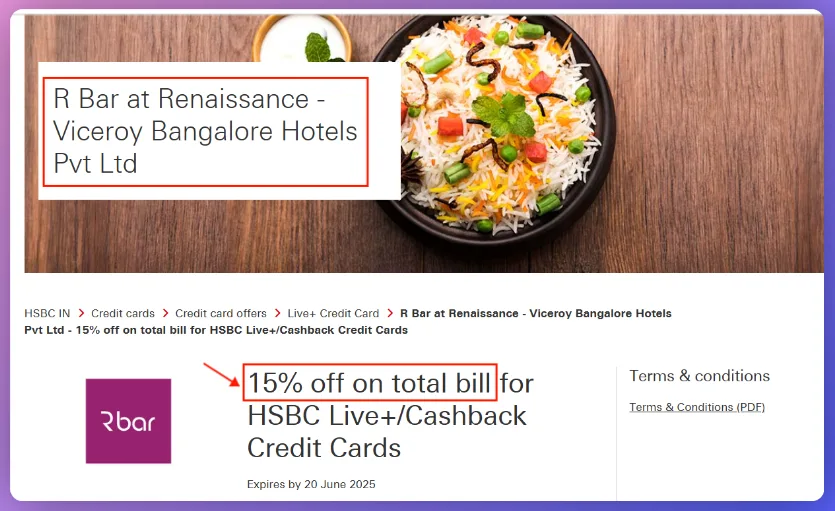

- Up to 15% discount on dining out in India and around Asia via HSBC Live+ Dining Offers.

- You get unlimited 1.5% cashback on shopping (online or offline), medicine, entertainment spends, and more.

- You also get 4 complimentary domestic airport lounge visits every year [ 1 visit once every 3 months ].

3. Axis My Zone Credit Card

What I Loved: Annual SONY LIV PREMIUM Subscription of total value Rs 1499.

The AXIS MY ZONE CREDIT CARD is one of the best options for foodies and entertainment lovers. This card is lifetime free, yet it comes with great premium benefits.

KEY BENEFITS:

- SWIGGY OFFER— Get Rs 120 off on minimum spend of Rs 500 using this card. You can avail this offer twice a month.

- SonyLIV Premium Subscription Valued at Rs 1499— Enjoy a Free 1-year SonyLIV Premium subscription. This benefit can be availed by making your 1st purchase within 30 days of receiving the card.

- Discount on Movie Ticket— You get up to Rs 200 off on booking 2nd movie ticket via the District App.

So, if the ticket price is Rs 200 or less, you get 100% discount on booking the 2nd ticket.

But what if the price is more than Rs 200?

Let us take an example.

Suppose you want to buy 2 tickets—one for yourself, and other for your spouse or siblings.

Let us say the price of one ticket is Rs 450.

In this case, you have to pay Rs 450 for the 1st ticket. But for the 2nd one, you only have to give Rs 450 minus discount of Rs 200 i.e., 250 rupees.

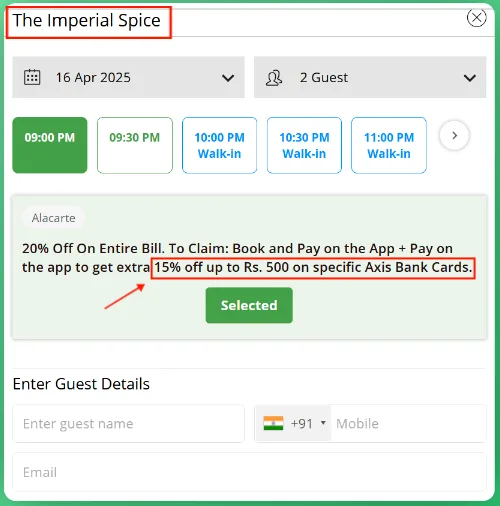

- Dining Discount: Enjoy up to 15% off [Up to Rs 500] at partner restaurants via Dining Delight program. The offer is valid once per month, and can be availed by giving a minimum food order of Rs 2500.

4. Eazydiner IndusInd Bank Platinum Credit Card

WHAT I LOVED: EazyDiner Prime Membership for 3 months [Total Savings = Rs 1095].

If you love eating out and want to save on your restaurant bills, this card is a great pick.

The best part? It’s lifetime free, so there’s no joining or annual fee— just pure benefits.

Read this post to find a right Lifetime Free Credit Card 👉 LIST OF BEST LTF CARDS 2025.

KEY BENEFITS:

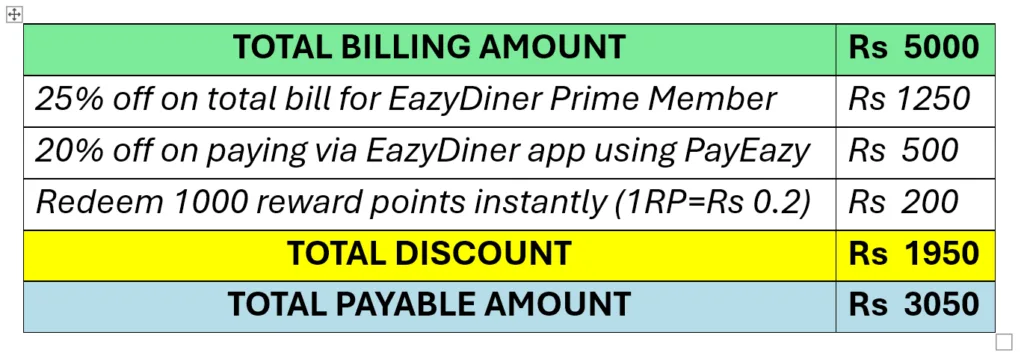

- EazyDiner Prime Membership– We get 3 months of EazyDiner Prime Membership with total value of Rs 1095. As an EazyDiner Prime member, you get flat 25% to 50% off at over 2000+ restaurants and food bars.

- You get additional 20% off up to Rs 500 when you pay your dining bills via the EazyDiner app only using the PayEazy payment option.

- Reward Points: You get 2 reward points on every spent of Rs 100. As value of each reward points is Rs 0.2, you receive 0.4% cashback.

Suppose the total billing amount is Rs 5000, and assuming you have 1000 reward points in your account. Here’s a breakdown of how you can save the most while eating out:

5. Airtel Axis Bank Credit Card

What I loved: 25% cashback on airtel mobile, Wi-Fi, and DTH bill payments.

Airtel Axis Bank credit Card is one of the best options for everyday spends.

It gives you fantastic deals on dining and food delivery, grocery spends, utility bills, airtel bill payment and more.

The joining fee for the 1st year is Rs 500, and from 2nd year, you have to pay an annual fee of Rs 500. You can apply for this card if :

• You’re 18-70 years old.

• You’re an Indian resident.

KEY BENEFITS:

- 25% Cashback on Airtel Bills: We get 25% cashback [up to Rs 250/month] on airtel mobile recharge, Wi-Fi, broadband, and DTH bill payments via Airtel Thanks App.

- We get 10% cashback [up to Rs 250/month] on utility bill payments, such as gas, electricity, etc. via Airtel Thanks App.

- We get 10% cashback for spends on Bigbasket, Zomato, and Swiggy. But the total cashback for spending on all these apps is capped at Rs 500 per month.

Let us know about the cashback offer in more detail.

Suppose Mohanlal spends Rs 12,500 in a billing cycle using this card. His total spending is shown below:

- Airtel mobile, Wi-Fi recharge : Rs 5000

- Gas, electricity, etc. bills: Rs 2500

- Total spends on Bigbasket, Zomato, and Swiggy : Rs 5000

Let us calculate his total cashback for above spends.

- Mohanlal will get 25% cashback for airtel mobile, Wi-Fi recharge. => 25% of Rs 5000 = Rs 1250 (But total cashback is capped at Rs 250 per month. Therefore his eligible cashback is Rs 250.)

- For gas, electricity, and other utility bills, he will get 10% cashback, capped at Rs 250 per month. => 10% of Rs 2500 = Rs 250.

- Finally, for total spends on Bigbasket, Zomato, and Swiggy, he will get 10% cashback, capped at Rs 500 per month. =>10% of Rs 5000 = Rs 500

Hence, the total cashback earned by Mohanlal in a billing cycle = Rs 250 + Rs 250 + Rs 500 = Rs 1000.

If he spends the same way in the whole year, he can manage to get Rs 12000 from cashback.

Final Thoughts 📢

Saving on food delivery is easy when you have the right credit card. In this blog, we looked at 5 of the best credit card for online food delivery in India, each offering great value in its own way.

Just choose the one that matches how you spend. Even small savings on each order can add up over time.

Hope this guide helped you find the right credit card for food delivery and dining.

Happy Savings 💵