I’ve always been a movie fan. Good movies have always been my favorite way to recharge every weekend.

But to be honest, going to the movies isn’t cheap anymore. And by ‘movies,’ I don’t just mean the ticket price alone. There’s everything else you pay for to make the outing feel complete — food, cola, maybe parking, or even premium seating.

Add it all up, and a simple night at the movies can end up costing more than you’d think.

In such a situation, having a good credit card with cashback or discount on entertainment spends can really help.

I hope this post will help you find your true “movie-companion”.

My Fav 5 List on the Best Credit Card For Movie Tickets

1. RBL BookMyShow Play Credit Card

Best For: Spends on BookMyShow

RBL Bank BookMyShow Play is an entertainment credit card with both the joining and annual fee as Rs 500.

All the benefits are focused around spends on the BookMyShow app or website.

This is a solid option if you are a movie lover (like me 😊) and use BookMyShow for online booking of movie or event tickets.

Key Benefits of RBL BookMyShow Play Credit Card

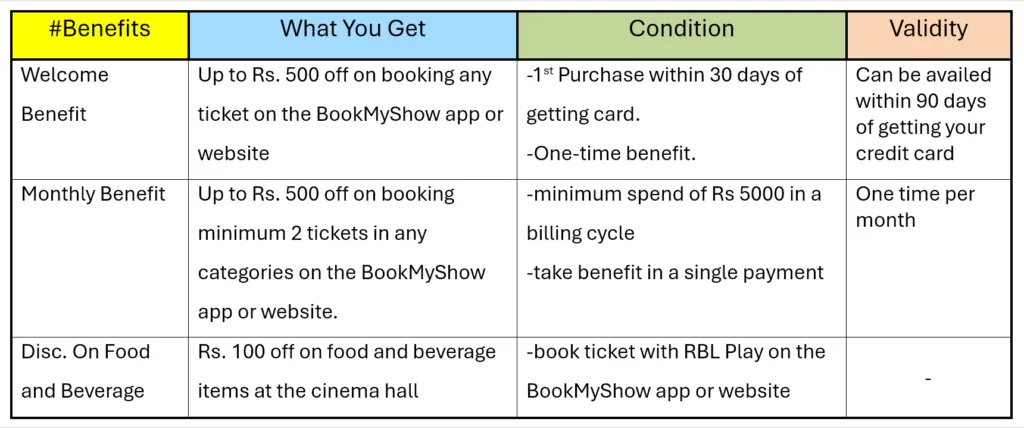

Welcome Benefit:

For your 1st payment within 30 days of getting the card, you get Rs. 500 off on booking any ticket on the BookMyShow app or website.

This offer is valid for 90 days (from the day of card issuance).

Monthly Benefit:

This offer is provided on hitting minimum spends of Rs. 5000 in a month. You get Rs. 500 discount for booking minimum two movie, event, or other ticket on the BookMyShow app or website.

For each ticket, we get discount of Rs 250.

Also note these conditions for monthly benefit:

- This offer is valid once per month. If you have taken advantage in May (say for ex.), you can again take monthly benefit in June (or any other month) if you’re able to hit a minimum spend of INR 5000 in that month.

- Applicable for booking minimum 2 ticket (movie, event, or other) on BookMyShow app or website

- You are allowed to take the benefit in a single payment in a month.

Food and Beverage Offer:

We also get Rs. 100 off on purchasing food and beverage items at the cinema hall.

Condition?

Book movie ticket with RBL PLAY on the BookMyShow app or website.

What I don’t like about RBL Play Credit Card?

RBL Play is great for movie lovers. You get good discount on booking movie, event, or other category of ticket on BookMyShow.

But beyond that, there isn’t much more about the benefits.

You do not get any cashback on your everyday spends like shopping, dining, or fuel.

Also, the movie offer is limited to once per month, and only on BookMyShow.

Therefore, if you are looking for a well-rounded card (not only movies), you may ignore RBL Play.

2. PVR Kotak Platinum Credit Card

Best for: Spends on movies and FnB purchase at PVR

PVR Kotak Platinum is another card in the list with great discount on spends at PVR cinemas.

It is also based on movie-related spends like ticket booking and food and beverage (FnB) purchases.

You do not have to pay any joining fee for this card. However, an annual fee of INR 999 is levied every year.

Key Benefits of PVR Kotak Platinum Credit Card

Free PVR Movie Tickets:

2 free movie tickets (each up to Rs 400) every month on spending minimum Rs 10,000 in a billing cycle.

So, if the ticket price is Rs 400 or less, you will get 100% discount on booking ticket with PVR Kotak Platinum.

**Also note that the discount is applicable only for PVR tickets**

Cashback On Offline Ticket or FNB Purchases

If you are fond of booking movie ticket offline, then you’re once again going to love Kotak Platinum.

You get flat 15% cashback [ up to Rs 750 ] on Food and Beverage Purchases at the FnB counter at PVR cinemas.

In the same way, you get flat 5% cashback [ up to Rs 250 ] on movie tickets if you buy it from the Box Office counter at PVR cinemas.

You can avail this offer up to 4 times a month for both movie and FnB purchases (Movie -> 4 times/ month ; FnB -> 4 times/month).

3. SBI Elite Credit Card

Best For: Travel and movies

SBI Elite is a premium-segment card with amazing benefits on travel and movies.

Other than these two categories, it also promises 5X reward points on dining, and grocery spends. In simple language, we get 1.25% cashback in these categories.

SBI Elite has a one-time joining fee of INR 4,999, that you are supposed to pay in the 1st year. From 2nd year, a renewal fee of INR 4,999 is charged every year.

The renewal fee can be waived off on spending Rs 10 lakhs or more in the previous year.

Key Benefits of SBI Elite Credit Card

Free Movie Tickets Worth Rs. 6000:

You get up to Rs 250 discount on booking movie ticket from the BookMyShow.

But this offer is valid for booking at least 2 tickets in one go every month. You can avail this benefit only once in a month.

Welcome Benefit:

As a welcome benefit, we get an e-gift voucher of Rs 5000. You can redeem your e-gift voucher for spends on a range of travel and fashion brands, like—

- Pantaloons

- Hush Puppies/ Bata

- Yatra (link)

- Aditya Birla Fashion

- Shoppers Stop (link)

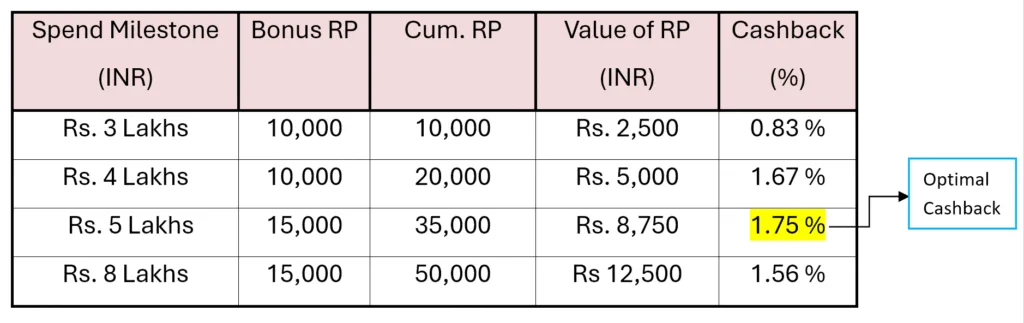

Milestone Benefits (my fav):

I really love the milestone benefit of SBI Elite. You can earn up to 50,000 bonus reward points (RP) every year. Below is the complete breakdown:

We can see in the above table that on spending Rs 5 Lakhs in a year, can lead us to the optimal cashback.

4. PVR INOX Kotak Credit Card

Best For: Unlimited Movie Tickets

PVR INOX Kotak is one of the top names in the list of “Best Movie Credit Card”. If you are looking for a true “movie-companion”, then you can definitely bet on this card.

The joining fee in this card is zero. But you will have to pay an annual fee of Rs 499 from the second year onwards. There is no option to waive the annual fee.

Let us have a look at the key benefits.

Key Benefits of PVR INOX Kotak Credit Card

5% discount on movie ticket:

5% off on booking movie ticket every time at any PVR or INOX Cinemas. You can also take this benefit by booking on the PVR or INOX app and website.

20% discount on Food and Beverages:

As I have said it before, PVR INOX Kotak Credit Card has everything you need for a great movie time.

Then how can it keep you away from “Popcorn” and “Cola” in your favourite movie 😊 ?

Yes, you’ve read it right! You can save 20% of your money in purchasing “Food and Beverages” at any PVR or INOX Cinemas, and also on the PVR or INOX app and website.

Unlimited Spend-based Movie Tickets:

| Monthly Spends (INR) | No. of tickets (or M Coupons) |

| Rs 10,000 or less | None |

| Between Rs 10,001 to Rs 20,000 | 1 |

| Between Rs 20,001 to Rs 30,000 | 2 |

| Between Rs 30,001 to Rs 40,000 | 3 |

| Between Rs 40,001 to Rs 50,000 | 4 |

| Between Rs 50,001 to Rs 60,000 | 5 |

| …. and so on | More than 5 |

Now we’ve finally arrived at the standout feature of the PVR INOX Credit Card.

In this benefit, you get 1 free movie ticket on every spend of Rs 10,000 in a month. Each ticket, also known as the M Coupon, is capped at the value of Rs 300.

For example, if you’ve spent Rs 45,000 in a month using this card, you are eligible for 4 tickets or M coupons.

Once eligible, you can claim the “M coupons” on the Kotak mobile banking app within 2 monthly billing cycle.

5. Axis Bank My Zone Credit Card

Best for: Dining and Movies

Axis Bank MY ZONE Credit Card can be your best pick if you love the combo of “good food and good movies”.

This credit card used to be lifetime free, but as of date, you need to pay a joining fee of Rs 500, and annual fee of Rs 500.

Key Benefits of Axis Bank My Zone Credit Card

Buy one Get One Offer on Movie Ticket:

You get up to Rs 200 off on booking your 2nd movie ticket via the “District” app.

SonyLiv Premium membership:

On making your 1st purchase within 30 days, you can get an annual SonyLiv Premium membership worth Rs 1499.

Swiggy Offer:

You get flat Rs 120 off on food delivery at Swiggy on a minimum spends of Rs 500. You can take this benefit twice a month (2 times/month).

If you loved this card, you can apply using this link.

Final Thought

A good movie night should leave you with great memories, not a dent in your wallet.

And as little costs can add up, a little planning — like picking the right credit card can make a big difference.

At the end of the day, it’s all about making those movie moments memorable — not costly.

I hope you’d have loved the post.

If you have anything to say about this post, you can comment below. I’ll be happy to discuss.

See you Soon!!

HAPPY SAVING!!