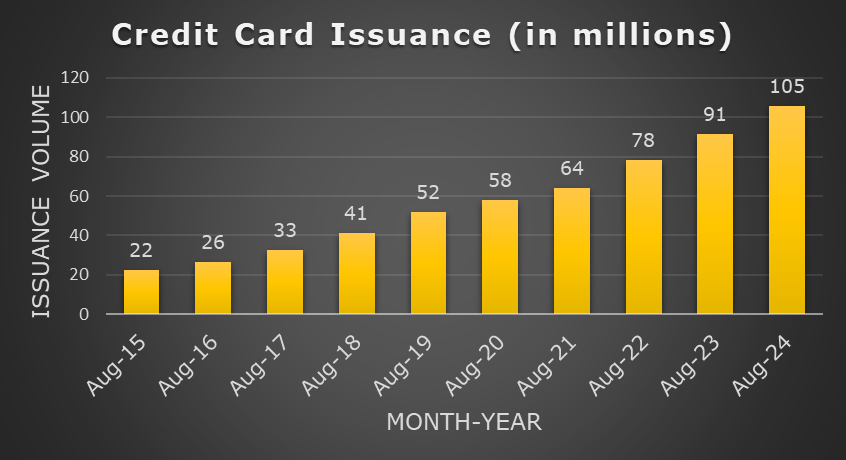

Credit Card users in India is growing at a rapid pace. As per the RBI Data, the total number of credit card issued by banks in India set a new milestone by surpassing the 100-million mark in February 2024. The graph below shows the rise in number of credit card issuance in the past 10 years.

Data Source: RBI

Credit card is becoming a part of our everyday life (especially for people living in Tier-I city). From cashback to golf rounds – credit cards cater to a variety of needs.

However, today we are going to discuss some of the best credit card for defense personnel in India.

Yes.. you have read it right!

Banks also issue credit cards for military personnel. Whether you are in the Army, Navy or Air Force, there is a credit card available to suit your needs.

Let us take a look at these 7 Best Credit Cards for Indian Military Personnel.

1. INDIAN ARMY YODDHA BOBCARD

The Indian Army Yoddha BOB Credit Card is one of the best credit cards for defense personnel in India. This credit card is lifetime free and you do not have to pay any kind of joining and annual fees.

You get 10 Reward Points on spending Rs 100 on shopping and movies. This amounts to 2.5% cashback ( 1 RP = Rs 0.25 ).

Eligibility:

- You must be a member of the Indian Army.

- Age limit is between 18 to 70 years.

- For Add-on Card, you need to be above 18 years old

Benefits that I liked:

- As a travel benefit, you get 8 complimentary domestic lounge visits every year. I love this benefit as you usually do not get lounge access in a lifetime free credit card.

- You get a 6 months FITPASS Pro Membership of worth Rs 15000 as a welcome bonus.

- If you spend Rs 5000 within 60 days of card issuance, you will be rewarded with 500 reward points.

1 RP = Rs 0.25

Therefore, 500 Reward Points = Rs 0.25 * 500 = Rs 125

How much will be the Cashback?

Cashback = ( Rs 125 / Rs 5000 ) * 100 = 2.5%

- In Built Insurance Cover: This is the standalone benefit of this credit card. You get free personal accident death coverage of Rs 20 Lakhs for both air and non-air travel.

- Fuel Surcharge Waiver: 1% Fuel Surcharge Waiver at all fuel stations in India for fuel spends of Rs 400 to Rs 5000. There is a cap on this discount i.e., you can take total benefit up to Rs 250 in a statement cycle.

- Smart EMI Options: This credit card gives you the option to convert purchases above Rs 2500 into EMIs of 6 to 36 months.

Benefit that I do not like

The Indian Army Yoddha BOB Credit Card is an all-rounder card as it takes care of a variety of needs. From shopping and entertainment to travel and insurance– we get multiple benefits with a single credit card.

However, there is one thing which I genuinely do not like in this credit card.

And that is the Milestone Benefit.

This is mentioned that if you spend at least Rs 1 lakh within 90 days, you will get 12 months of Amazon Prime membership.

Now, the Amazon Prime membership fee for 1 year is Rs 1499. Then, why would someone spend Rs 1 lakh to get this membership?

AMAZON PRIME MEMBERSHIP FEE TABLE

| Plan | New Price |

| Monthly Prime (1 month) | ₹ 299 |

| Quarterly Prime (3 months) | ₹ 599 |

| Annual Prime (12 months) | ₹ 1499 |

| Annual Prime Lite (12 months) | ₹ 799 |

| Prime Shopping Edition (12 months) | ₹ 399 |

ICICI BANK PARAKRAM SELECT CREDIT CARD

The list of top credit cards for defense personnel in India is incomplete without this gem of the ICICI Bank. The ICICI Bank Parakram Credit Card is issued in honour of the Indian defense and paramilitary personnel. It is also available for lifetime free and is known for a blend of lifestyle benefits. This is the only credit card in this list that give you international airport lounge access without any annual fee. You also get complimentary golf round access.

Do you remember any lifetime free credit card with this kind of benefit?

It’s rare, right?

Reward Points

We get 10 Reward Points on spending Rs 100 ( 2.5% Cashback ) at Grocery Stores, Department Stores, and CSD.

There is an upper limit on the number of reward points. We cannot earn more than 1000 reward points in a single month. Two things can be derived from this statement:

- We cannot get more than Rs 250 cashback in a single month.

- If we spend more than Rs 10,000 in a month, it will not give us any reward points.

For Example: Suppose you spend Rs 15,000 in a month at any retail stores or CSD. Now, in this case, only Rs 10,000 is eligible for reward points. You will not receive any reward points or cashback on the remaining Rs 5,000 of the total amount.

Key Benefits

- Domestic and International Lounge Access : You get 8 complimentary domestic airport lounge access and 1 complimentary international airport lounge access every year.

- Golf Round Access: You can get this benefit only when you spend Rs 50000 from our credit card. A total of 4 golf rounds are given in a month and each round is available only after spending Rs 50000.

- Insurance Coverage: This credit card also gives you the personal accident insurance cover of Rs 2 lakhs and air accident cover of Rs 20 lakhs.

- Fuel Surcharge Waiver: You also get 1% fuel surcharge waiver at all fuel pumps in India. However, this is applicable only for fuel spends between Rs 400 and Rs 4000 and the upper limit of this discount is Rs 250 per month.

3. BOB VIKRAM CREDIT CARD

The Bank of Baroda Vikram Credit Card is another solid option for defense personnel. It is also available for lifetime free and you do not have to pay any kind of joining and annual fees.

This is a basic credit card which is limited only to a few options like shopping and movies. You get 5 reward points per Rs 100 spent on Movies and Department Stores, which simply gives you a cashback of 1.25%.

Benefits that I liked

- Welcome Benefit: As a welcome bonus, you get 500 reward points on spending Rs 5000 within 60 days of the card issuance.

1 RP = Rs 0.25

Therefore, 500 RP = Rs 500 * 0.25 = Rs 125

So, this will give you a cashback of 2.5%.

Moreover, you can activate 3 months of Disney+Hotstar subscription on your first payment within 30 days of card issuance.

- Insurance Coverage: Like BOB YODDHA, this credit card also offers free personal accident death coverage of Rs 20 Lakhs for both air and non-air travel.

- Smart EMI Option: You get the facility to convert purchases above Rs 2500 into EMI of 6 to 36 Months.

My Opinion

As I have mentioned, this is a basic credit card with major benefits limited to shopping (offline), movies, and insurance. From here we can also say that this credit card fails to meet the needs of travellers. You don’t get premium benefits like lounge visits or golf rounds with this credit card.

You can consider BOB VIKRAM if you:

- Travel less

- Spend major portion of your money on offline shopping

- Movie lover..

- Looking for insurance-benefits

4. SBI SHAURYA CREDIT CARD

SBI Shaurya is another member in the best credit card for defense personnel in India. It is issued to the serviceman in Airforce, Army, Navy, and Paramilitary. Like BOB VIKRAM, you may dislike this credit card as a traveller. However, you get more options to earn reward points. You get 5X reward points (X= 1 and 1 RP=Rs 0.25) per Rs 100 spent on CSD, Dining, Department Stores, and Grocery, which is 1.25% cashback.

It is not available for lifetime free. The one-time joining fee is Rs 250, and the annual fee is also Rs 250.

Key Benefits

- Welcome Bonus: The cardholders get 1000 reward points (Rs 250) as a welcome gift. However, you will get these reward points within 15 working days of payment of annual fee for the 1st year.

From here, it can also be said that the annual fee for the 1st year is zero (in practical). After paying the annual fee, you get the same amount back as welcome bonus.

- Insurance Benefit: As an insurance benefit, you can avail complimentary personal accident insurance cover of Rs 2 lakhs.

- Fuel Surcharge Waiver: You get 1% fuel surcharge waiver at all fuel stations in India for fuel purchases between Rs 500 to Rs 3000. The upper limit for this discount is Rs 100 per statement cycle, which is low in comparison to other credit card in this list.

- Annual Fee Waiver: You can waive off your annual fee (for the following year) on spending Rs 50,000 or more in a year.

5. AXIS BANK PRIDE SIGNATURE CREDIT CARD

AXIS Bank Pride Signature Credit Card is another member in this list that is available for free for the 1st year. From the 2nd year onwards, you have to pay Rs 500 as the annual fee.

The major benefit of this credit card is limited to dining, travelling, and fuel. Unlike other member, this credit card does not provide any kind of insurance coverage.

Key Benefits

- Domestic Lounge Access: As a travel perks, you get 2 complimentary visits to domestic lounges in every three months. However, there is a spend-based condition for this benefit. You need to spend minimum Rs 50,000 in the previous 3 calendar months to avail this benefit in the following months. So, for example, if you have spent total Rs 50,000 in April, May, and June, then you will get 2 domestic lounge visits in the July, August, and September.

- Dining Benefit: This is one of the prominent benefits of this credit card where you get minimum 15% discount at all the partner restaurants.

- Fuel Surcharge Waiver: For all fuel purchases between Rs 400 and Rs 4000, there is 1% fuel surcharge waiver. The overall discount you can get in a statement cycle is Rs 400.