Axis Bank My Zone Credit Card Review: Axis Bank My Zone Credit Card is an entry-level card providing all-round benefits in multiple segments, like food, entertainment, travelling, and shopping.

It was issued for “Lifetime Free” under a limited-time offer. But, as of current date, it is coming with an annual and joining fee of Rs 500 (+GST).

If you have failed to grab that “Lifetime Free” offer, you don’t need to disappoint. You can still earn handsome return over your costs.

Read this Review Post to know about the Axis Bank My Zone Credit Card in detail.

OVERVIEW: AXIS BANK MY ZONE CREDIT CARD

| FEATURE | DETAILS |

| Type | Lifestyle Credit Card |

| Best For | Dining and Entertainment |

| Reward rate | 0.4 % |

| Joining Fee | Rs 500 + GST |

| Annual Fee | Rs 500 + GST |

| Annual Fee Waiver | NIL |

| Welcome Benefit | Sony Liv Membership worth Rs 1499 |

REWARD POINTS

On every spend of Rs 200, we get 4 reward points (known as the EDGE REWARD Points).

Each EDGE REWARD Point is worth Rs 0.20. So, you earn 0.4% reward rate on your spends.

Also, there are limited options to earn those EDGE REWARDS. No reward points is credited if you are spending on the below listed categories:

- Movie

- Fuel

- Insurance

- Wallet Load

- Rent

- Utilities

- Jewellery

- Education

- Government Institutions

- EMI transactions

REWARD POINTS REDEMPTION

- You can redeem your rewards points at the EDGE REWARDS CATALOGUE.

- 1 EDGE REWARD = Rs 0.2 (20 paisa) at the Edge Rewards Catalogue

MILESTONE BENEFITS

You also get 1000 EDGE REWARD Points on achieving milestone spends of Rs 1.5 lakhs in a year.

Now, considering that a card member is able to achieve this milestone spend, we can calculate the return% as follows:

Total Milestone EDGE REWARD Points = 1000

Now, we know that 1 EDGE REWARD is credited on every spend of Rs 200.

So, on spend of Rs 1.5 lakhs, the card member will earn 750 EDGE REWARD Points [ considering all the spend is done on eligible MCC Categories].

Hence, return% =[ {(1000 + 750 ) * Rs 0.2}*100 ] / Rs 1,50,000 = 0.23%

Therefore, even if you achieve the milestone benefit, you’ll still get a low return of 0.23%.

So, Axis Bank My Zone Credit Card is going to disappoint you in terms of earning from reward.

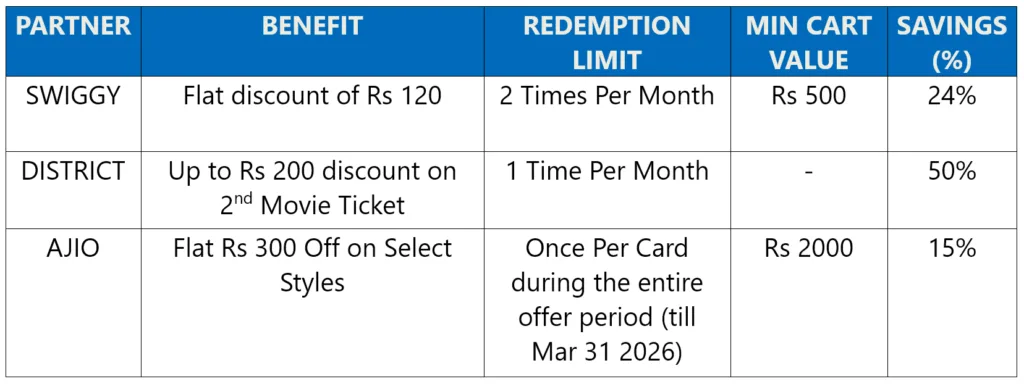

INSTANT DISCOUNT ON SWIGGY

Axis Bank My Zone Credit Card is a good option if you are using it for food and entertainment.

You get flat discount of Rs 120 on food delivery at Swiggy. But for this, you need to place a minimum order of Rs 500.

You can avail this discount 2 times per month on Swiggy.

So, cardmembers can save 24% in a month on online food delivery at Swiggy.

AJIO SHOPPING DISCOUNT

Card Members can get flat Rs 300 off on Select Styles for minimum purchase of Rs 2000 at AJIO.

You must use the Coupon Code – AJIOAXIS300 during checkoutto get the discount.

This offer is valid till 31st March 2026. You can avail the discount only one time during the entire period since it is a once-per-card benefit.

ENTERTAINMENT BENEFITS

1. Buy One Get One Offer On Movie Tickets

Card members can enjoy up to Rs 200 discount on the 2nd movie ticket booked via the District app.

So, if you’re buying two movie tickets of Rs 400 each, then you need to pay for one of them.

On the 2nd ticket, you will get discount of Rs 200.

Therefore, in total, you will pay Rs 600 for buying both the tickets.

This benefit can be availed only once per month.

2. Sony Liv Membership Worth Rs 1499

Cardholders can also enjoy the annual Sony Liv Membership of Rs 1499 as a welcome benefit.

You can unlock this initial membership with your 1st purchase, provided that the purchase is made within 30 days of your card being issued.

But to retain this benefit for upcoming year, you must meet the annual spending milestone of Rs 1.5 lakhs.

RECAP OF ALL PARTNER BENEFITS

Here’s is the recap of all partner benefits (if you are in a hurry)-

All the savings rate above are optimal. So, on movies, you can save 50% only if each ticket cost is Rs 200 or less.

But if the ticket cost is more than Rs 200 each (e.g. Rs 300 each), you only save Rs 200 on a total spend of Rs 600 (savings rate drops to around 33.3%).

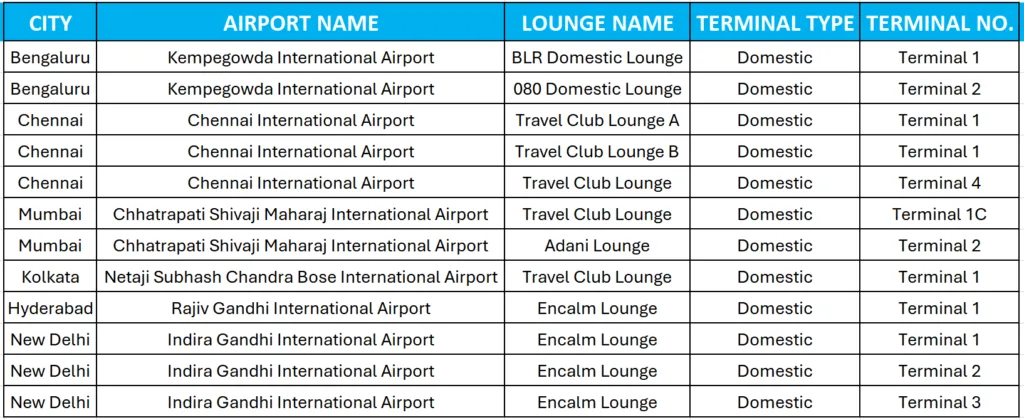

LOUNGE ACCESS

Cardmembers can also take advantage of 4 domestic lounge visits in a year.

From 1st May 2024, the lounge benefit is provided only if you spend Rs 50,000 in the previous 3 calendar months.

However, there are only few lounges that you can visit with this credit card. Below is the list of domestic lounges:

FINAL THOUGHTS

My Zone can be good option if you want variety of lifestyle benefits at low joining or annual fees.

You get amazing discount on shopping, food, and movies.

You also get 4 domestic lounge visits in a year.

But there are some major disadvantages that you can’t ignore.

There is no option to waive annual fee. I know most of us do not care about it a lot.

But it’s still a disadvantage 🙂

Lounge benefit is complimentary. But you need to meet a spending milestone of Rs 50K every three months.

Also, there are limited lounges that you get to visit. You might dislike it if you regularly travel within India.

So, this was all about the Axis Bank My Zone Credit Card Review.

I hope you’ve loved the post!

I have compiled all the pros and cons of the Axis My Zone Credit Card.

If I have missed anything, you can remind me in the comment.

Till Then,

Happy Saving !!