5 Best Credit Card For Buying Gold Jewellery in India: For many people in India, buying gold is a big deal. For us, it is much more than just a purchase; it’s a significant investment. We often link gold to festivals, weddings, or smart ways to save money.

Unlike other common payment methods, credit card is a better alternative for buying gold and jewellery. They are fast, safe, and earn valuable reward points.

But to be honest, only a handful of banks actually offer benefits on expensive buys like gold jewellery.

So, I dug deep to find the best options and compiled everything in one easy-to-read list.

I’ve highlighted only the jewellery-specific benefits so that your decision is easier and more informed.Here are the 5 best credit cards for buying gold jewellery in India in 2025.

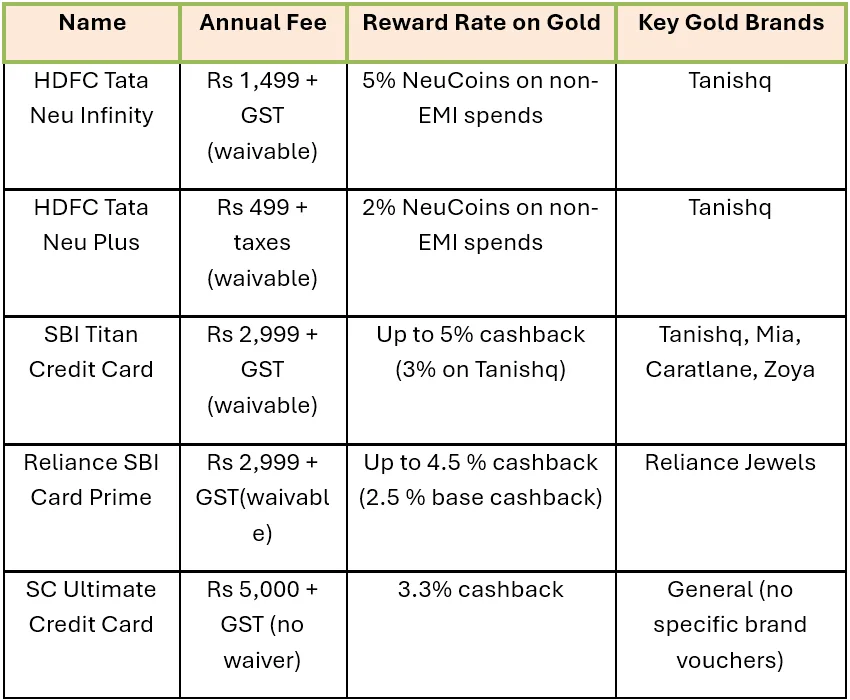

COMPARISON: Best Credit Card For buying Gold Jewellery in July 2025

1. HDFC Tata Neu Infinity Credit Card

| Feature | Detail |

| Reward Rate on Tata Brands (Non-EMI) | 5% NeuCoins |

| Reward Rate on Non-Tata Brands | 1.5% NeuCoins |

| UPI Spends | 1.5% NeuCoins (capped at 500/month) |

| Joining Fee | Rs 1,499 + GST (offset by 1,499 NeuCoins) |

| Annual Fee Waiver | Spend ₹3,00,000+ annually |

| Key Jewellery Brands | Tanishq |

HDFC Tata Neu Infinity Credit Card is best for spends on Partner Tata Brands.

The joining fee is zero. But you’ve to pay an annual fee of Rs 1499 (+GST) from 2nd year onwards. However, you can get this fee waived if you spend Rs 3 Lakhs or more in a year.

Here, Reward Points is known as NeuCoins. NeuCoins are easy to use within the Tata ecosystem at 1:1 value i.e., 1 NeuCoin = Rs 1.

We get a notable 5% cashback on purchases made at Tanishq— which is a prominent Tata brand. However, this benefit applies to Non-EMI spends.

You also get the option to pay using EMI. But in that case, you will be rewarded with 1.5% cashback.

HDFC Tata Neu Infinity has a long list of T&Cs, and it can be confusing for most of us. But since we are focusing on jewellery spends, there are few things you must keep in mind for optimum benefits.

- You can redeem your NeuCoins for jewellery spends at Tanishq only via Tata Neu.

- Only principal amount of EMI is calculated for NeuCoins. No NeuCoin is given on interest, processing fees, and GST amounts on the EMI.

- If you’ve chosen the EMI option to purchase jewellery, then also keep in mind that no NeuCoins are allotted for Smart EMI or Dial an EMI.

2. SBI Titan Credit Card

The SBI Titan Credit Card is a very special co-branded card. It’s an outstanding choice if you buy gold and jewellery from the wide range of Titan Group brands, like Tanishq, Mia, Zoya, and Caratlane.

SBI Titan offers a substantial value-back of up to 5% on gold and jewellery purchases. This is a valuable and very rare feature in the Indian credit card market.

| Feature | Detail |

| Value-back on Tanishq | 3% (capped at Rs 25,000 per quarter) |

| Cashback on Mia, Caratlane, Zoya | 5% (capped at Rs 10,000 per quarter) |

| Reward Points (outside Titan Ecosystem) | 6 Points on every Rs 100 [1 RP = Rs 0.25] |

| Joining Fee (known as “annual fee” here) | Rs 2,999 + GST (offset by 12,000 points) |

| Annual Fee (known as “renewal fee” here) | Rs 2, 999 + GST |

| Annual Fee Waiver | Spend Rs 3,00,000+ annually |

For spending outside the Titan ecosystem, cardholders earn 6 reward points on every Rs 100 spent. This is a decent 1.5% cashback.

The joining fee of SBI Titan Credit Card is Rs 2,999 +GST. However, this cost can be compensated from the welcome benefit.

In this benefit, you get 12000 reward points (12000 points X Rs 0.25 or Rs 3,000) once you pay the joining fee.

You are also levied an annual fee of Rs 2,999 +GST, which can be waived if you spend Rs 3,00,000 or more in a year.

3. Reliance SBI Card Prime

| Feature | Detail |

| Instant Discount at Reliance Jewels | 2% on making charges/diamond value |

| Reward Points (Reliance Retail) | 10 points per Rs 100 |

| Reward Points (Other Categories) | 5 points per ₹100 (Dining, Movies, Airlines, International Spends) |

| Joining/Annual Fee | Rs 2,999 (offset by ₹3,000 voucher) |

| Annual Fee Waiver | Spend Rs 3,00,000+ annually |

Reliance SBI Card Prime is best for offline jewellery spends.

Since it is a co-branded card, most of the benefits are tied to spends on the Reliance Retail Stores.

Cardholders get 10 reward points on every Rs 100 spent on a range of retail stores, including Reliance Jewels. With a redemption rate of 1 RP = Rs 0.25, this means a notable value back of 2.5% on your total spend.

But, wait, there’s another layer to it.

We’ve not discussed about milestone benefits yet.

On annual spends of Rs 75,000 at listed Reliance Stores, you get Reliance Retail Voucher worth Rs 1500.

Now, you may want to calculate your return on annual spends of Rs 75,000 at Reliance Jewels.

1. Reward Points-

Since we are spending at Reliance Jewels, and it is one among the listed Reliance Stores.

So, on spends of Rs 75000, you get 7500 reward points (10 RP/Rs100)

7500 Reward Points can be redeemed for Rs 1,875 (since 1 RP = Rs 0.25).

2. Milestone Benefits-

As we have already discussed, on annual spends of Rs 75,000 you get Reliance Retail Voucher of Rs 1500.

Now, on combining both, we can earn Rs 3,375 on the spend of Rs 75,000. So, we can enhance the scope of return from 2.5% to 4.5% by leveraging the milestone benefit.

3. Instant discount on making charges-

In addition to the above benefits, you also get 2% instant discount on making charges while purchasing gold at Reliance Jewels. You can use it twice per month.

This type of discount, especially on components like making charges (which can be a big part of jewellery costs), gives you immediate and real savings.

Since it is not given on total spend, it’s not good to categorize it as “cashback”. But it definitely save our money.

4. Standard Chartered Ultimate Credit Card

| Feature | Detail |

| Reward Rate (Most Spends) | 3.3% (4 RP per Rs 150) |

| Joining/Annual Fee | Rs 5,000 + GST (offset by 6,000 points) |

| Renewal Fee Waiver | Nil |

| Redemption Type | Vouchers (no specific jewellery brands) |

Standard Charterd Ultimate is a super-premium credit card with a strong reward rate of 3.3% on almost all type of spend categories.

The joining and annual fee are both Rs 5000 +GST.

However, when you pay the joining fee, you earn 6000 Reward Points. Since, 1 RP = Rs 1, these reward points can be redeemed for Rs 6000. So, there is a joining fee on paper. But, in reality it doesn’t bother you much.

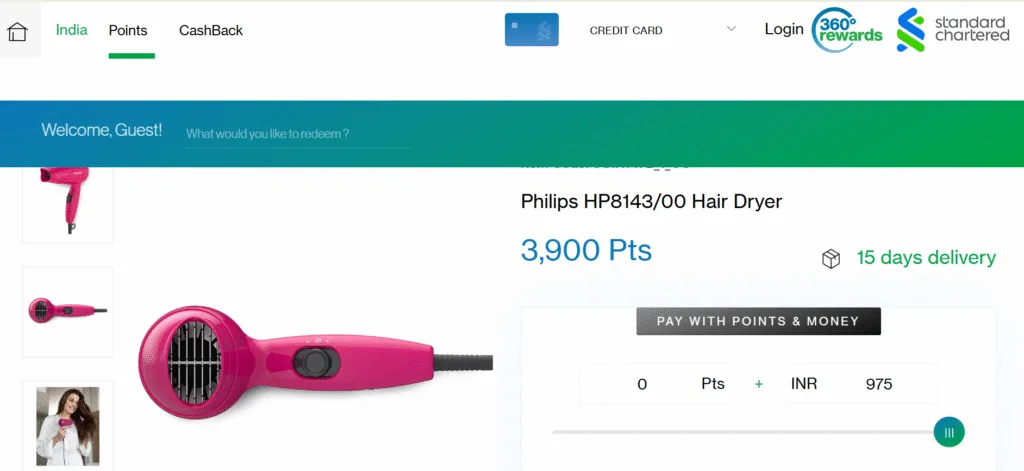

Reward points can be redeemed at the 360 Rewards catalogue against a long list of categories like fashion, home and kitchen appliances, hotels, and gadgets.

The value of each reward point is Rs 0.25 when redeemed from the rewards catalogue.

Previously, this card used to offer vouchers from specific jewellery brands like Kalyan, Tanishq, and PCJ. However, these vouchers have been permanently removed from the redemption catalogue.

You still earn same points on jewellery spends.

But you can now use them for other redemption options like travel, home appliances or as statement credit.

5. HDFC Tata Neu Plus Credit Card

| Feature | Detail |

| Reward Rate on Tanishq | 2% NeuCoins |

| Reward Rate on Other Non-UPI Spends | 1% NeuCoins |

| UPI Spends | 1% NeuCoins (capped at 500/month) |

| Welcome Benefit | 499 NeuCoins (offsets first-year fee) |

| Annual Fee Waiver | Spend Rs 1,00,000+ annually |

HDFC Tata Neu Plus is a lower annual fee credit card with potential rewards on jewellery purchase.

You get 2% back as NeuCoins on purchases made at Tata Brands (like Tanishq). Similar to HDFC Tata Neu HDFC Infinity, you get this benefit on Non-EMI spends.

For spending on Non-Tata Brand, you get 1% back as NeuCoins.

I do agree that we can’t compare HDFC Tata Neu Plus Credit Card with other members of this list.

But unlike them, this is a more economical option with benefits on jewellery purchase.

It comes with an annual fee of just Rs 499 +GST. Joining fee is also the same.

Annual fee for any year can be waived off if you’ve spent Rs 1 lakh or more in the previous year.

You can also eliminate the 1st year joining fee by leveraging the welcome benefit.

This was all about the 5 best credit card for buying gold jewellery.

Hope you loved the post!

We’ll meet soon with a new topic discussion.

Happy Saving !!