Axis Atlas Credit Card Review: If you’re looking at travel cards in India, the Axis Bank Atlas Credit Card is one you simply can’t ignore.

You get the option to earn airmiles (travel rewards) on everyday spends, enjoy staying at good hotels, and more— all without overspending.

On paper, it sounds like the best travel companion?

But is it good to add Atlas to our wallet?

Let’s find out in this detailed Axis Atlas Credit Card Review.

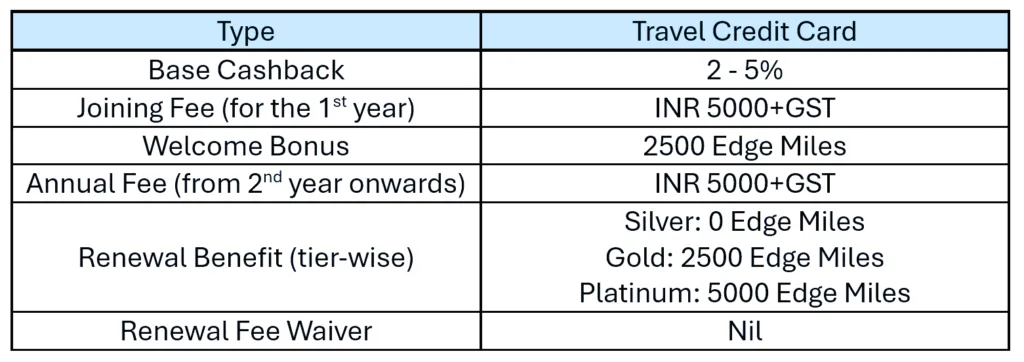

Glimpse of Key Features

Here’s an overview of the key features:

Axis Atlas Bank Credit Card Review: Reward Points

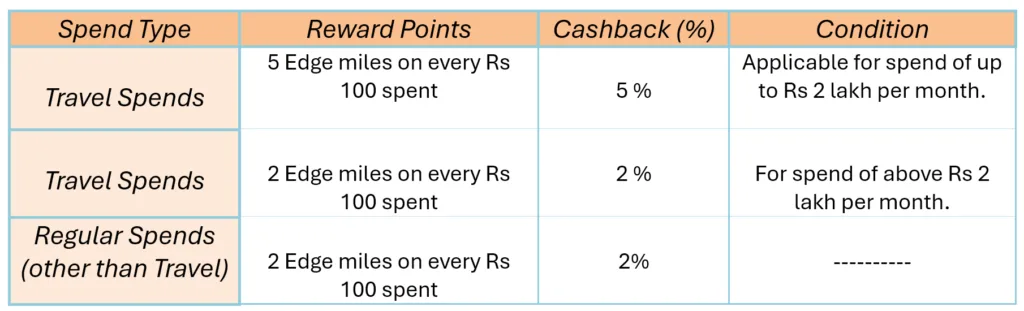

The reward points of this card are known as “EDGE Miles.”

You get cashback in the range of 2-4% depending upon the type of your spending. All the reward points are visible in the EDGE Miles Account of the cardholders.

For Travel spends like airlines & hotel bookings (specific merchants), and any spends made at the Axis Bank Travel EDGE Portal, you get 5 EDGE Miles on every Rs 100. This becomes 5% cashback.

For any other spends, you get 2 EDGE Miles per Rs 100 spent or 2% cashback.

NOTE: As you can see in the table, if your travel spends in a month is more than INR 2 Lakhs, you will get regular 2% cashback.

So, keep your travel spends within Rs 2 Lakh for optimum benefit.

List of spends that do not earn EDGE Miles (along with merchant code):

• Gold: 5094

• Jewelry: 5944

• Wallet Load: 6540

• Rent: 6513

• Insurance: 6300, 6381, 5960, 6012, 6051

• Govt. Institutions: 9222, 9311, 9399, 9402

• Utility bill: 4814, 4816, 4899, 4900

• Fuel: 5541, 5542, 5983

Axis Atlas Credit Card Review: Reward Redemption

There are two options to redeem your EDGE Miles:

• Booking Flights, hotels, and more at the Travel EDGE Portal.

This is a simple option where you can redeem your EDGE Miles in the ratio 1:1.

So, if you redeem your EDGE Miles using this option, the value of 1 EDGE Miles remains the same [ 1 EM = INR 1 ].

On the Travel EDGE Portal, you also get the option to redeem EDGE Miles by booking availability for single or multi-day tours, campaigns, and more.

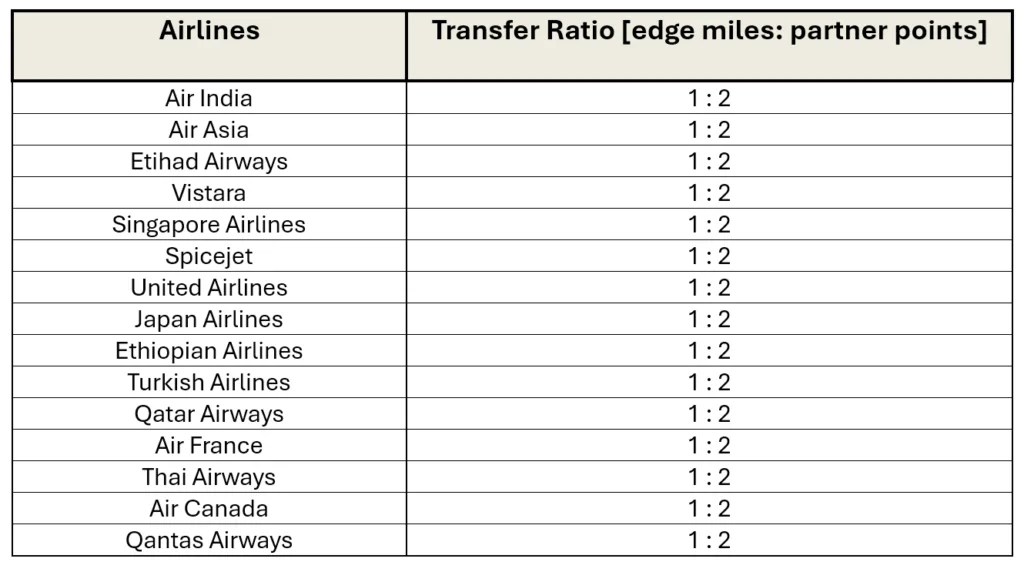

• Transferring EDGE Miles to Partner airlines and hotels.

Let us have a look at the transfer ratio of all the partner airlines:

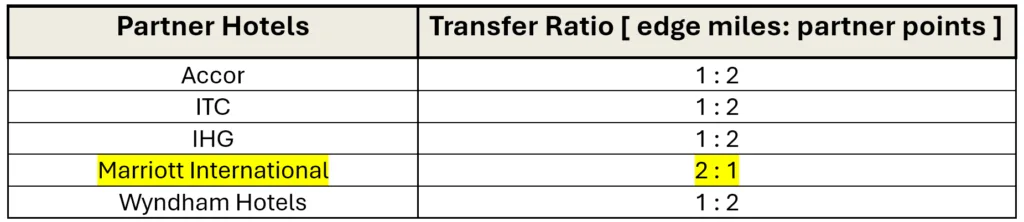

Let us have a look at the transfer ratio of all the partner hotels:

As you can look into the above tables, all the partner airlines and hotels have a transfer ratio of 1:2. But, for Marriott International, the EDGE Miles to Marriott Points is 2:1 i.e., after transferring EDGE Miles will become half.

Therefore, it is not a wise move to transfer EDGE Miles for booking hotels at Marriott.

Understanding Capping for Miles Transfer

For miles transfer, all the partner hotels and airlines are divided into two groups: A and B.

The total Edge Miles that can be transferred to partner points in a year is capped to 1,50,000 EDGE Miles.

There is also a sub-capping for each of the Group.

• Group A: Up to 30,000 EDGE Miles Transfer per year

• Group B: Up to 1,20,000 EDGE Miles Transfer per year

Here is list of partners for both the group:

Group A- Accor, Air Canada, Ethiopian, Etihad, Japan Airlines, Marriott, Qatar Airways, Singapore Airlines, Turkish Airlines, Thai Airways, United Airlines, and Wyndham Hotels.

Group B- Air India, Air Asia, ITC, IHG Hotels, Air France, Qantas Airways, Spicejet, and Vistara.

Milestone Benefits

You get up to 10,000 EDGE Miles as a milestone benefit.

Let us do a simple calculation to understand how you can get optimum benefit.

Suppose Madan manages to spend Rs 15 Lakhs in a year. His total spend can be divided into 70% on regular spends (INR 10.5 Lakhs) and 30% on travel spends (INR 4.5 lakhs).

Let us talk about the Regular spends such as dining, shopping, and other non-travel spends).

He will get 2 EDGE Miles for every Rs 100 spent. For spending Rs 10.5 Lakhs, total EDGE Miles for regular spends can be calculated as follows:

EM (R) = 2* (Rs 10.5 lakhs ÷ Rs 100) = 21000 [EM(R) is EDGE Miles on Regular Spends]

For travel spends, he will get 5 EDGE Miles on every Rs 100. So, total EDGE Miles can be calculated as follows:

EM (T) = 5* (Rs 4.5 lakhs ÷ Rs 100) = 22500 [EM(T) is EDGE Miles on Travel Spends]

Madan will also receive total 10,000 EDGE Miles as a milestone benefit.

EM (M) = 10000 [EM(M) is EDGE Miles for Milestone spends]

Hence, TOTAL EDGE MILES = EM (R) + EM (T) + EM (M) => 21000+22500 +10,000 => 53500

Redeeming Total EDGE Miles For Optimum Value

The total edge miles can be redeemed by transferring to partners like ITC or Accor Hotels.

ITC HOTELS: (2x Return)

Edge Miles can be transferred to ITC Green Points at a 1:2 ratio (1 Edge Mile = 2 ITC Green Points). Value of each green point is Rs 1.

So, 53500 EDGE Miles can easily be valued at INR 1,07,000, that can be redeemed to hotel stays, dining, spas, and more at ITC Hotels.

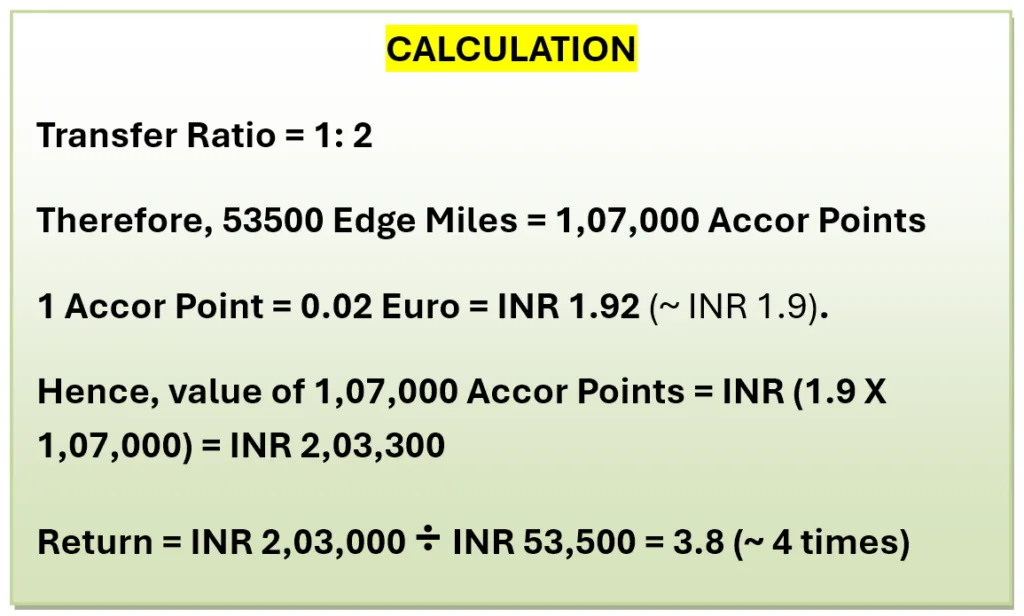

ACCOR HOTELS: (almost 4X return)

Edge Miles can be transferred to Accor Points at a 1:2 ratio (1 Edge miles =2 Accor points). And, value of each Accor point is 0.02 Euro (~ INR 1.9).

Please note I am considering Euro to INR Rate as of 1st May 2025.

EURO To INR Rate: 1st May 2025

So, 53500 EDGE Miles can easily be valued at INR 203300 (considering 1 Accor Point = INR 1.9)

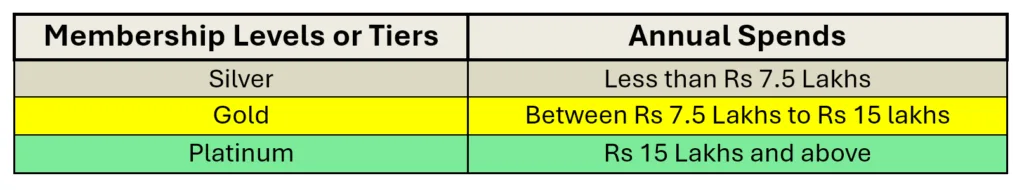

Understanding Membership Tier System

Atlas also comes with 3 membership levels or tiers- Silver, Gold, and Platinum.

Each tier is an indication of how much you have spent in a year using this card.

A new cardholder is initially kept in the Silver-tier. However, you can upgrade the membership to Gold-tier with a minimum annual spend of INR 7.5 Lakhs.

And if you want to enter the Platinum-tier, you will have to hit an annual spend of minimum INR 15 Lakhs.

Tier Upgrade or Downgrade:

It’s not that you will always be upgraded to the upper tiers. You can also be downgraded to lower tier if spending threshold for any upper tier is not met in the upcoming year.

Here’s the details:

| Existing Tier | Post Downgrade Tier |

| Silver | ——- |

| Gold | Silver |

| Platinum | Gold (If Rs 7.5 Lakhs =< annual spend < Rs 15 lakhs) |

| Platinum | Silver (If annual spend < Rs 7.5 lakhs) |

Lounge Visits

You get up to 18 domestic and 12 international lounge visits in a year. Here’s the tier-wise details for both type of lounges:

| Tier | Domestic Lounge Visits/Year | International Lounge Visits/Year |

| Silver | 8 | 4 |

| Gold | 12 | 6 |

| Platinum | 18 | 12 |

The plus point is that Atlas offers lounge access not only to the primary cardholders, but also to their guests. This is a great benefit if you travel with family or friend.

What I Loved about Axis Atlas Credit Card?

The best thing I liked in this card is the Miles Transfer feature.

You don’t just earn base reward points (edge miles) on your regular and travel spends. But you can also transfer these edge miles to partners like ITC and Accor— and get handsome return (as discussed above in the “Milestone Benefits”).

If you’re someone who loves redeeming for travel, Atlas can easily be one of the smartest choices out there.

Who Should Get Axis Atlas?

If you:

• Travel 2-3 times a year (domestic or international)

• Spend ₹7.5L+ yearly

• Love using miles for hotels or flights

Then yes, Axis Atlas Credit Card is a solid pick. But if you are just starting out with credit cards or rarely travel, then you might not unlock its full power. You may consider LTF card in that case.

Eligibility For Axis Atlas Credit Card

You are eligible for this card if you fulfill below conditions:

• You’re between 18 to 70 years old (for Add-on card, you should be above 18 years)

• You are an Indian resident.

• For salaried person, the net annual income must be INR 12 Lakhs and above.

• If you’re self-employed, your net annual income must be INR 15 Lakhs and above.

BOTTOM LINE 📝

Atlas isn’t for everyone. It’s designed for those who love travel and want real value for every rupee spent.

So, if you use it wisely, it easily pays back way more than its fees.

Also, as we’re into the bottom line, it can be said that atlas shines for travel-focused spending.

For taking optimum benefit, it is always better to use this card as a travel-companion, rather than a typical reward credit card.

This was all about the Axis Atlas Credit card Review.

Please comment any standout feature of axis atlas that you like the most [ with reason ].

Happing Saving !!