Meaning of SIP in Mutual Fund: If you invest in mutual funds or are investment conscious, then you must have heard about SIP (Systematic Investment Plan).

SIP allows us to invest a small amount of our savings in a systematic and regular manner. Undoubtably, It inculcates investment discipline and encourages us to continue our investment for a longer period.

In this blogpost, we will discuss about meaning of SIP, its working, benefits, and right time to begin SIP.

Meaning of SIP in Mutual Fund

A systematic Investment Plan is a method of investing in mutual funds wherein you are allowed to invest a set amount at regular time intervals.

The decision related to time interval is in your hands, and you can wish to invest weekly, monthly, semi-annually, or annually as per your convenience.

How Does SIP Work ?

SIP works similar to a piggy bank where we deposit a small amount of our savings regularly.

You need to specify a date and amount as you begin your investment. Based on the current Net Asset Value (NAV) of Mutual Fund, an additional number of units are allotted to investors in return of the amount they pay on each date of the SIP. This means you buy more units when the NAV is low and able to buy less units when the NAV is high. This concept is known as Rupee Cost Averaging.

Benefits of Investing in SIP

SIP is an easy and convenient way to invest in mutual funds. You can avail higher returns in future by investing a small amount regularly through SIP.

It offers various benefits to the investors:

1. Convenience

You can begin your SIP with a minimum amount of Rs 500. Such facility of SIP encourages even low-income investors to invest over a long period of time and earn high returns.

2. Rupee Cost Averaging

We know that market is volatile in nature, and it is difficult to predict the market trends or wait for the right time to invest in the stock market.

So the question is, how can we get rid of this problem?

This is possible with Rupee Cost Averaging (RCA) which comes as an advantage with SIP.

Rupee Cost Averaging helps us to buy more units when the market is down and we are able to buy fewer units when the market is up. This lowers your average cost per unit and helps in maximizing profits in the long run.

Let us understand this concept with the help of an example.

Suppose Sharma ji started an SIP in XYZ Mutual Fund with a fixed amount of Rs 1000 for one year. The following table shows his entire investment process through SIP:

| MONTH | SIP AMOUNT (in INR) | NAV (in INR) | NO. OF UNITS |

| Month 1 | Rs 1000 | 10 | 100 |

| Month 2 | Rs 1000 | 8 | 125 |

| Month 3 | Rs 1000 | 5 | 200 |

| Month 4 | Rs 1000 | 8 | 125 |

| Month 5 | Rs 1000 | 10 | 100 |

| Month 6 | Rs 1000 | 20 | 50 |

| Month 7 | Rs 1000 | 25 | 40 |

| Month 8 | Rs 1000 | 20 | 50 |

| Month 9 | Rs 1000 | 10 | 100 |

| Month 10 | Rs 1000 | 8 | 125 |

| Month 11 | Rs 1000 | 4 | 250 |

| Month 12 | Rs 1000 | 10 | 100 |

Let us find out his profit in one year.

Total Investment = Rs 12000

Total units earned = 1365

- Average Cost per unit = Total Investment/Total units earned = 12000/1365 = 8.79

- Average Price (value) per unit = Sum of all NAVs/Time span (months) = 138/12 = 11.5

It is obvious that the average cost per unit is less than the average price per unit. This means Sharma ji made an average profit of Rs 2.71 on every units purchased by him.

This is how you benefit from Rupee Cost Averaging by investing through SIP.

3. Power of Compounding

The Great Scientist Albert Einstein once said-

Compound Interest is the 8th wonder of the world. He who understands it, earns it…he who doesn’t…pays it

What exactly a compounding is?

Compounding is a great way to generate income on the re-invested income. It works on two basic premises:

1. Re-investment of income

2. With the passage of time

If you really want to take advantage of compounding, then you should initiate SIP soon and continue your investment for a longer tenure, say 10 years or 15 years. The sooner and longer you invest, the more benefit you will get from compounding, and the higher will be your returns.

Let us understand with the help of an example.

Suppose three investors A, B, and C started an SIP in the same mutual fund with same amount of Rs 5000 per month. Let A, B, and C continue their investment for 10, 20 and 30 years respectively.

The following table shows their entire investment process:

| Investor | Time Period (in Years) | Return | Deposit Amount | Maturity Amount | Total Interest |

| A | 10 | 12 % | Rs 6,00,000 | Rs 11,61,695 | Rs 5,61,695 |

| B | 20 | 12 % | Rs 12,00,000 | Rs 49,95,740 | Rs 37,95,740 |

| C | 30 | 12 % | Rs 18,00,000 | Rs 1,76,49,569 | Rs 1,58,49,569 |

You can notice from the above table that Investor B continued his investment for 10 more years than Investor A, and earned almost 7 times more interest. Investor C, on the other hand, continued investment for 20 more years than A, and made 28 times more interest than investor A.

4. Amazing Returns

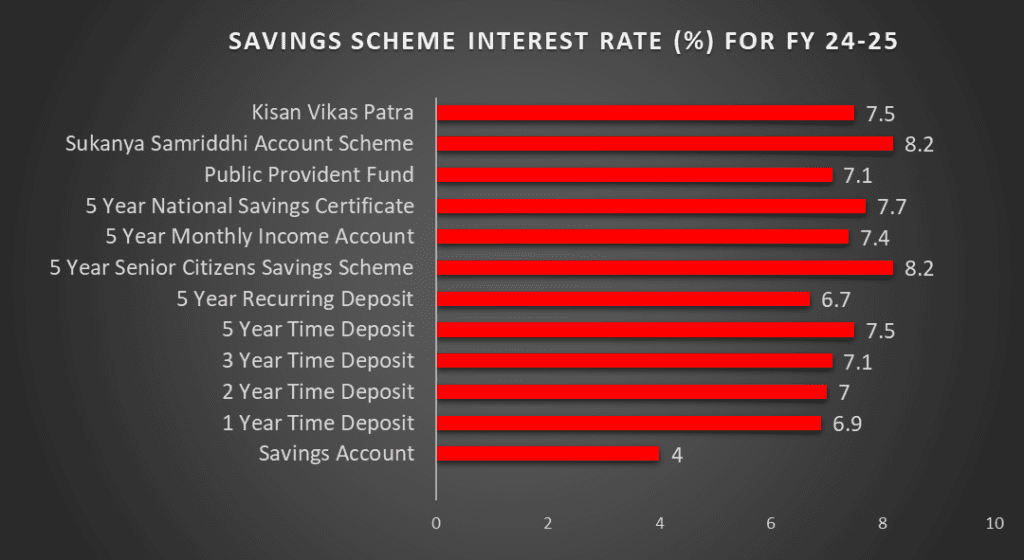

SIP has the potential to give higher returns than many other savings scheme and traditional investment options like Recurring Deposit. However, the return you get from SIP depends on the type of mutual fund you have chosen for SIP. Debt Funds are stable investment options, but if you are looking for long-term wealth generation, you can jump-in for equity funds.

Below you can refer the interest rate offered by various savings scheme in the FY 24-25:

5. Build Financial Discipline

SIP inculcates the habit of investment discipline among investors as they commit to invest at regular time period.

However, we’ve all missed an installment now and then. If that’s happened to you, you can make things easier by automating your investment. This can be done by setting auto-debit feature or by submitting post-dated cheques.

It’s a simple way to stay on track without the hassle. You can invest effortlessly, even on your busiest days. It might feel like nothing’s changing, but over time, you’ll see your money grow!

6. Flexibility

SIP gives you the following flexibility as an investor :

- You can Skip, Stop and Start an SIP-

You do not have to pay any fine in case you miss an SIP payment or want to Stop SIP for any reason. This gives you an edge over investment options like Recurring Deposits, where you have to pay a fee in such a situation.

Additionally, you can always begin a new SIP in same or different mutual fund whenever you need.

- You can increase or decrease the SIP Amount-

SIP gives you the freedom to adjust your investment as life changes.

If you get a promotion or have more to save, you can easily increase your SIP amount with the Top-up option. And if you face a setback in your career, you can lower the amount to suit your current situation.

This flexibility makes it easier to stick with your investment, no matter what life throws at you. Isn’t that amazing?

Is there any right time to begin SIP?

I’ve noticed that many investors often get caught up in figuring out the right time to begin SIP.

But here’s the good news…

If you invest via SIP, then you do not need to worry about the right time to invest. This is because you get the benefit of Rupee Cost Averaging, and it helps you beat the market swings.

All you need to do is choose a date that fits your schedule and stay consistent with your investments.

HAPPY INVESTING😊