18 Mutual Fund Terms You must know: Many times we come across small terminologies that we are not aware of while starting to invest in mutual funds.

There are a number of frequently used mutual fund terms that investors should be familiar with in order to understand the ABCs of mutual fund investing. I have tried my best to cover 18 such mutual fund terms in a single place.

Let’s see one by one!

Mutual Fund Terms You should Know

1. Corpus

Corpus is the total sum of money of all the investors in a particular scheme.

For Example: Suppose that there are 100 units in an equity fund with each unit worth Rs 10. Then the corpus in this case will be Rs 1000.

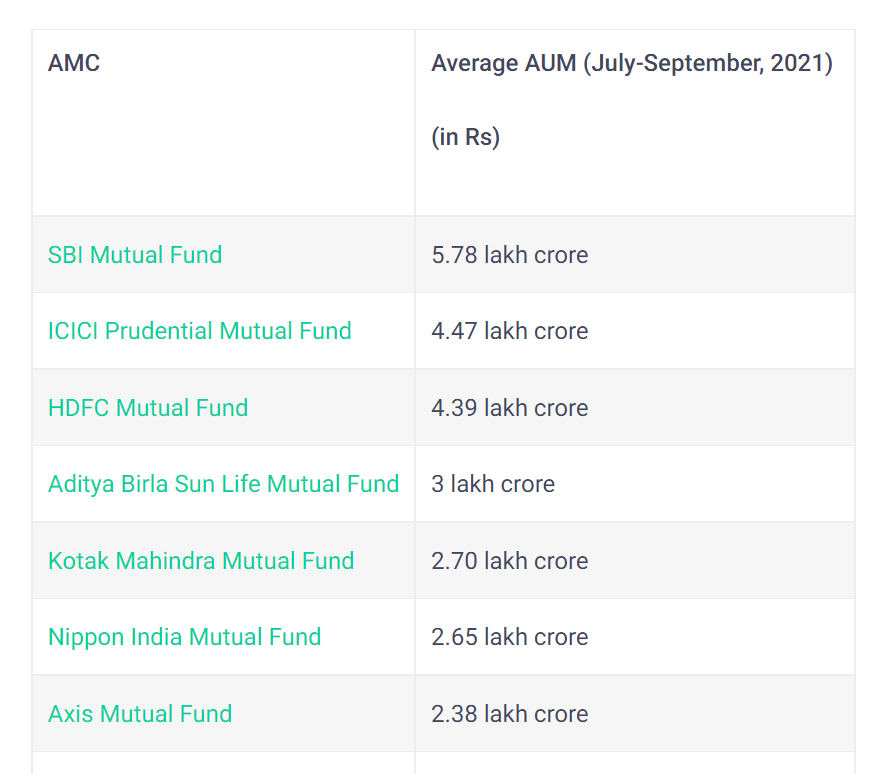

2. AMC

AMC stands for Asset management Company. They are the investment firm or company that pools money from the investors and invest on behalf of them in exchange of some fees.

3. CAGR

The full form of CAGR is Compounded Annual Growth Rate. CAGR is the annual rate of growth of an investment, taking compounding into account.

4. Portfolio

The portfolio of a fund shows the collection of financial assets such as stock, bond, cash, etc.

For Example: If an equity fund has invested 65% of total money in stocks, 15% in bonds and kept remaining of 20% as cash, then stock, bond and cash will be the component of the portfolio of this fund.

The portfolio of a fund may also consist of the assets like gold, commodity, real estate, etc.

5. AUM

AUM stands for Asset Under Management. This refers to the market value of the corpus.

Here is the list of top AMCs in India (2021)-

Credits: Groww.in

6. NAV

NAV stands for Net Asset Value.

We are aware that AMC collect money from us and give us units in exchange. The value or price of this single unit is known as the NAV or Net Asset Value.

7. Expense Ratio

The fund house charges a small fee from the investors to manage their money. This fee is known as the Expense Ratio.

Expense Ratio (ER) = Total Expenses/Total Assets (AUM)

Credits: ET Money

8. Entry Load

This is the fee charged by an investor to join a fund or scheme. You can call it the ‘entry fee’ for a mutual fund. However, since August 2009, SEBI has prohibited levying of entry load on mutual funds.

9. Exit Load

It is the fee to be paid in case you redeem the investment of a fund before a specified time frame (as mentioned in the Scheme Information Document).

For Example: Suppose you invest Rs 10,000 in a fund with the exit load as 1% if you redeem before 1 year. The NAV of the fund is Rs 100, i.e., you buy 100 units.

Let us assume that you redeem your money after 5 months with the NAV as Rs 110.

Then, the exit load you will have to pay is-

Exit Load = 1% of [Rs110 (NAV)*100 (no. of units)]

= Rs 110

Final Redemption Amount = [Rs 110 (NAV)*100 (no. of units) – Rs 110 (Exit Load)] = Rs 10,890

| Initial Investment | Rs 10,000 |

| NAV at the time of Investment | Rs 100 |

| Units Bought | 100 |

| Final NAV | Rs 110 |

| Exit Load | 1% (Rs110*100) |

| Final Redemption Amount | Rs 10,890 |

10. NFO

NFO stands for New Fund Offer.

This is the term given to a new mutual fund scheme. The NAV or price per unit of an NFO is usually set at Rs 10.

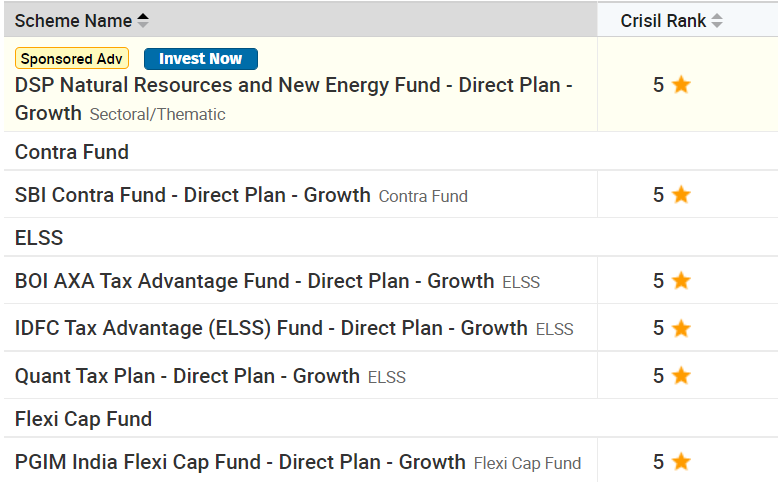

11. CRISIL Rating

The full form of CRISIL is Credit Rating Information Servicesof India Limited.

CRISIL takes the responsibility to rank various financial institutions including mutual funds in India on the basis of its research.

You can use the CRISIL Rating to choose a better fund.

Source: Moneycontrol

12. Fund Benchmark

A benchmark refers to a yardstick/standard against which the performance of a fund is measured.

For Example: The benchmark of Kotak Small Cap Fund Direct Growth is Nifty Smallcap 100 TRI.

13. Regular Plan

In Regular Plan, an investor buy/sell the mutual fund units through an intermediary such as broker or distributor.

Regular plans have lower returns because of the higher Expense Ratio which rises due to the payment of commission to the broker.

14. Direct Plan

In Direct plan, an investor buy/sell mutual fund units directly from the fund house without the intervention of any agent or broker.

Direct Plans offer higher returns due to lower Expense Ratio.

15. Lock-in Period

It is the time period during which you can’t redeem/sell your investments. The Lock-in Period for tax-saving funds [ELSS] in India is 3 years.

16. Dividend Option

In this option, regular dividends are paid out to the investors from the profit made by the scheme. You can choose this option if you want to receive regular cash flow.

17. Growth Option

In Growth option, the profit is re-invested in the market instead of being paid out to the investors. This option can be fruitful if you wish to fulfil any long-term goal.

18. Asset Allocation

Asset allocation is an investment strategy of diversifying your portfolio into different asset classes like Equity, Debt, Gold and Cash.